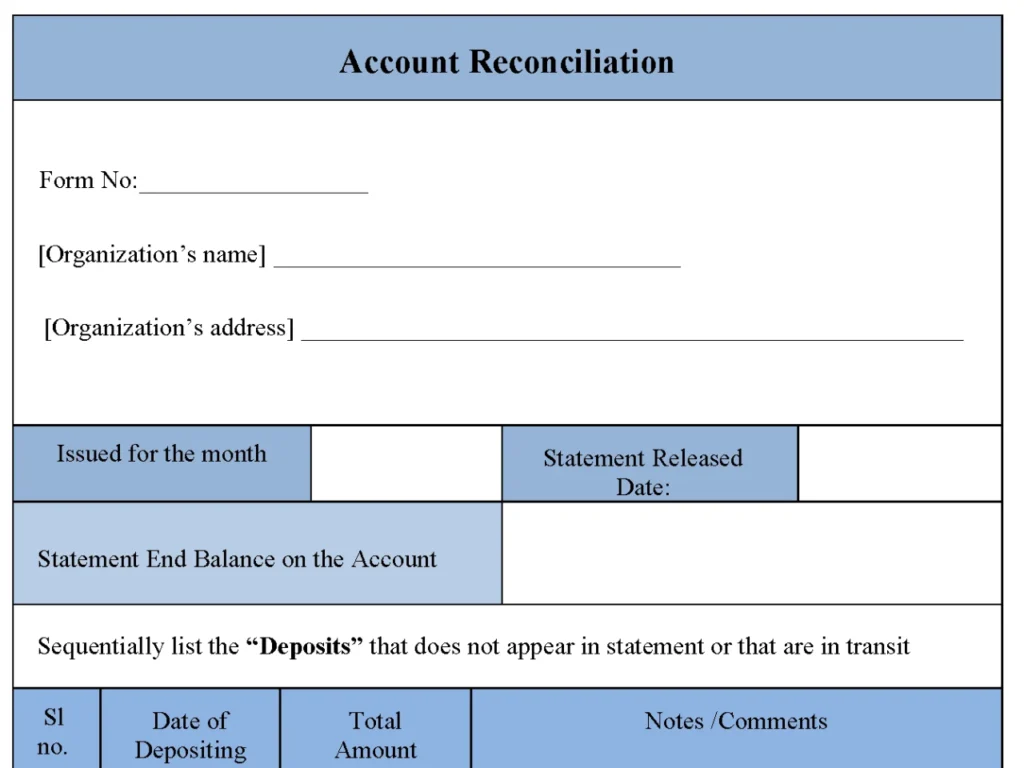

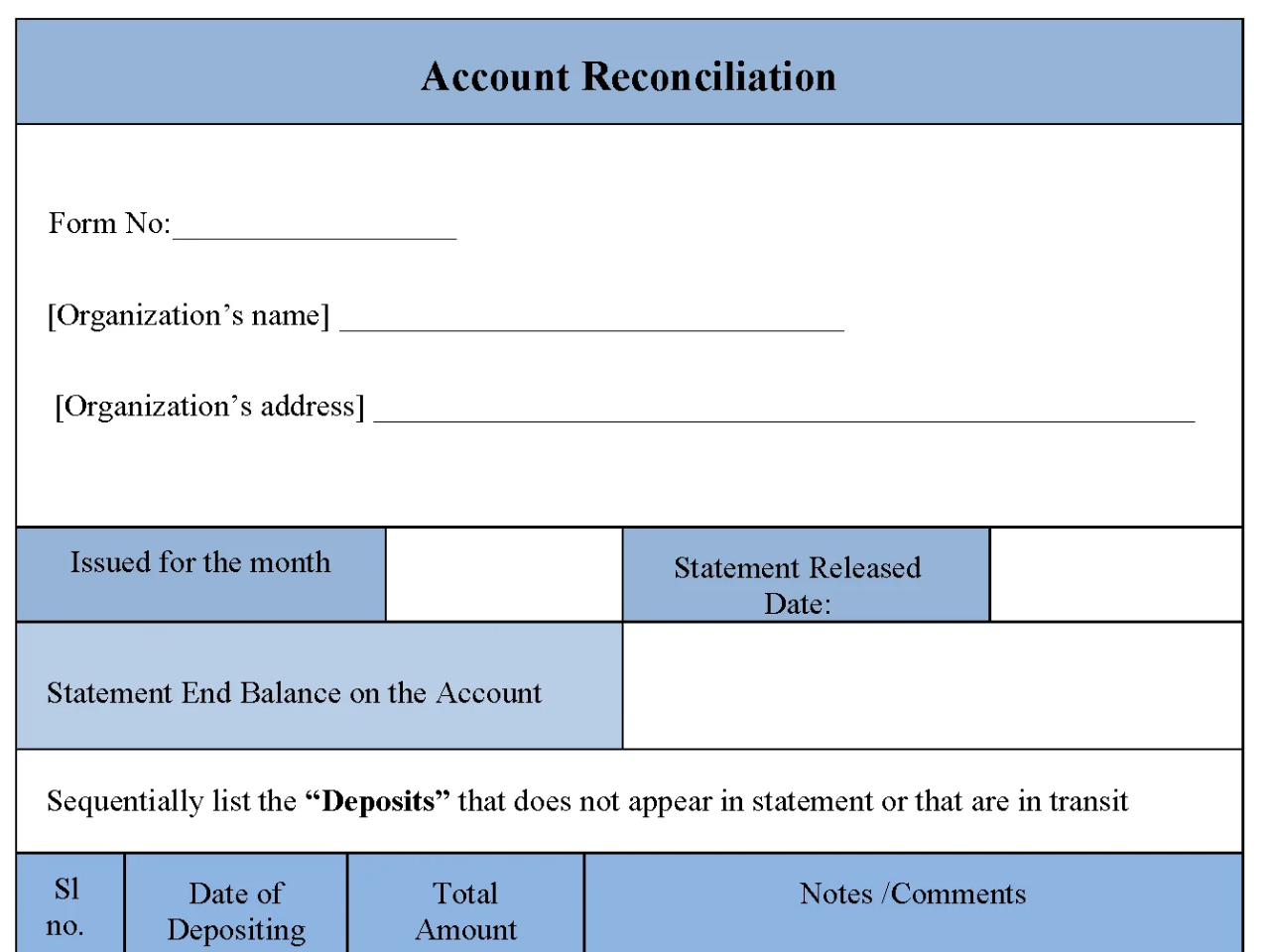

Account reconciliation form is a pre-built layout used for reconciliation various aspects of an account with its user(s). This extends from bank account reconciliation to business account reconciliation. However, the objective behind all account reconciliation form is to check whether an individual’s personal tenets sync with the records of the authority or not.

This kind of a form has to be drafted with utmost precision and professionalism. Moreover, it is always advisable to draft an account reconciliation form with general lineation so that it could offer the flexibility of customization to the user according to their need.

You can Download the Account Reconciliation Form post; customize it according to your needs and Print. Account Reconciliation Form is either in MS Word and Editable PDF.

Download Account Reconciliation Form for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Detailed Transaction Recording:

Provides structured fields to document deposits, withdrawals, outstanding checks, and also fees, enabling comprehensive tracking of account activity.

Balance Calculation Section:

Calculates opening, closing, and adjusted balances, simplifying the reconciliation process and also reducing manual errors.

Error Detection Fields:

Includes spaces to identify and note discrepancies, such as duplicate charges or unrecorded transactions, facilitating a thorough review.

Customizable Fields for Multiple Accounts:

Adaptable for different account types (e.g., checking, savings, business accounts), making it versatile across various financial needs.

Date and Signature Lines:

Allows users to document when the reconciliation was completed, adding a layer of verification and also accountability.

Benefits:

Ensures Accurate Financial Records:

Helps individuals and businesses verify account balances, ensuring financial records are correct and up to date.

Improves Financial Accountability:

Promotes regular reconciliation, reducing the risk of unauthorized transactions or accounting errors.

Simplifies Tax Preparation:

Organized records and also accurate balances streamline tax reporting, helping prevent issues during audits.

Facilitates Better Budgeting:

By tracking cash flow precisely, it supports more accurate budget planning and also financial forecasting.

Strengthens Fraud Detection:

Regular reconciliation can quickly identify suspicious transactions, enabling proactive measures to address potential fraud.