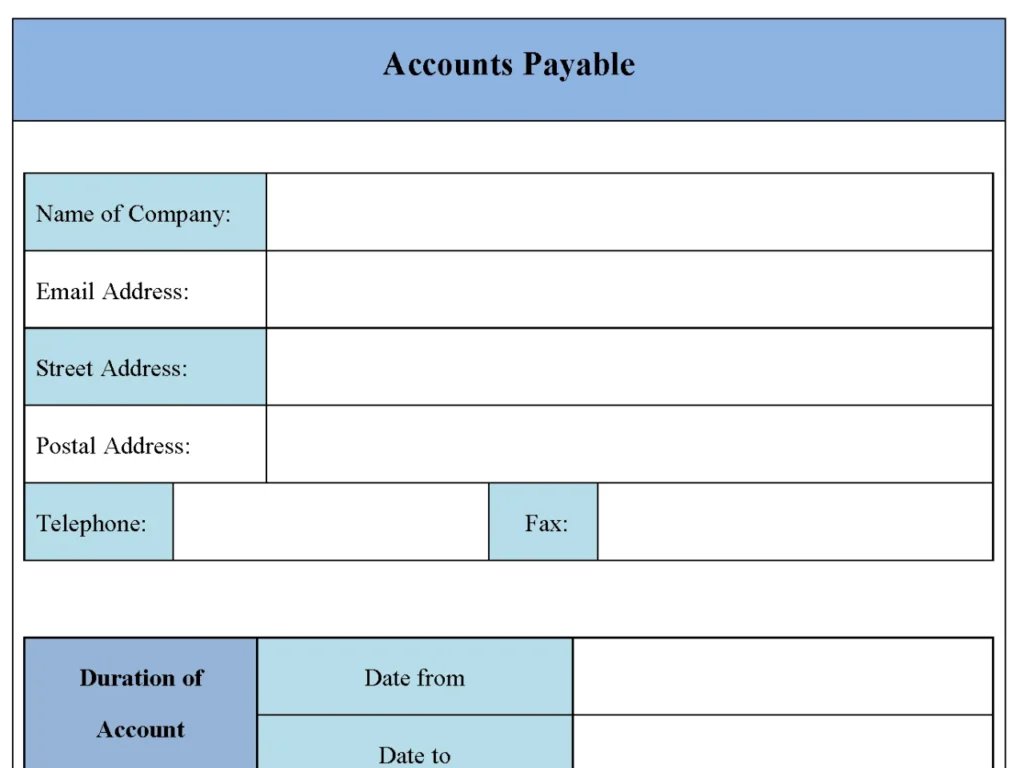

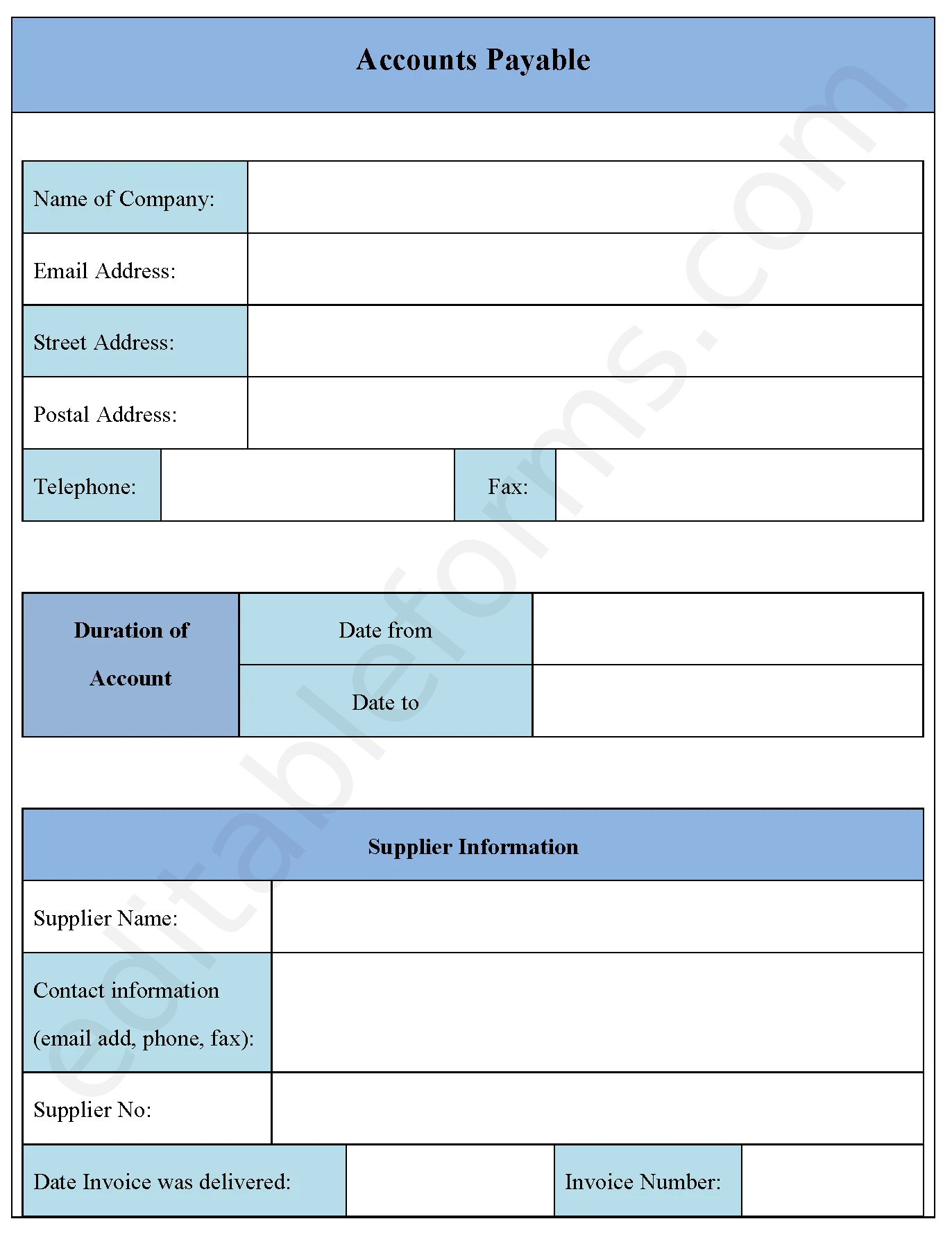

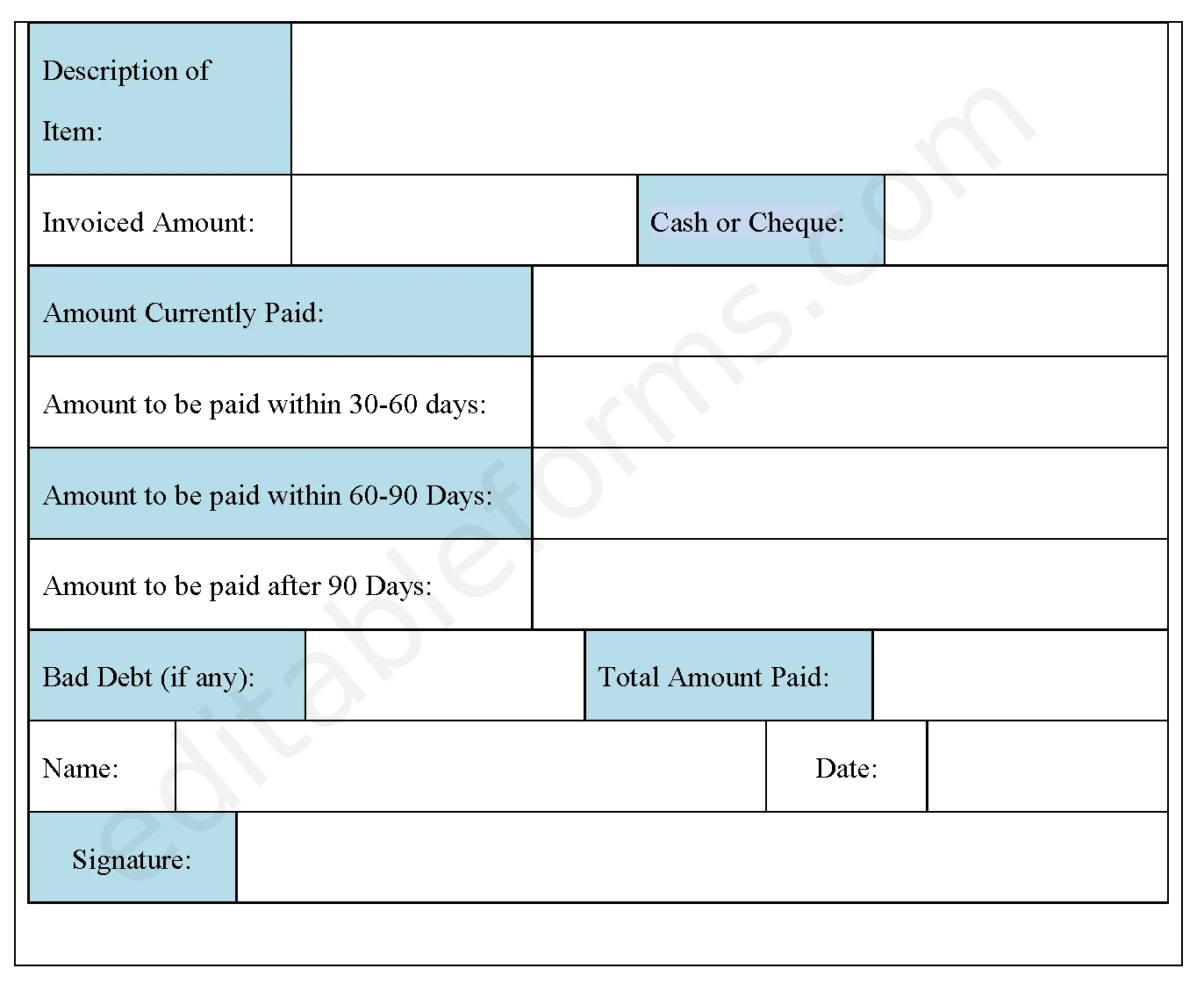

The accounts payable form is also known as the aging of accounts payable form. The accounts payable form shows the money a business owes to its suppliers, which is yet to be paid. This form is used to help you identify the accounts not fully paid for and it is sometime called the trade payable. Suppliers allow delivery of supplies so they are paid for at a later date. Below is a sample accounts payable template.

You can Download the Accounts Payable template post; customize it according to your needs and Print. Accounts Payable template is either in MS Word and Editable PDF.

Download Accounts Payable Form for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Invoice and Payment Tracking:

Provides fields to record invoice details, due dates, vendor information, and payment statuses, ensuring accurate tracking of payables.

Approval Workflow Section:

Includes designated areas for authorizations and approvals, streamlining the process for payment approval and accountability.

Expense Categorization:

Allows categorization of expenses (e.g., utilities, supplies, services) for organized and detailed financial records.

Automatic Calculations:

Supports fields for automatic totals and calculations, reducing manual entry errors and saving time.

Document Upload Capability:

Offers space to attach digital copies of invoices, receipts, and also related documents, centralizing records for easier access and also auditing.

Benefits:

Improves Cash Flow Management:

Helps businesses monitor upcoming payments, optimizing cash flow by avoiding missed payments and also late fees.

Enhances Vendor Relationships:

Streamlines payment processes, ensuring timely payments that build trust and also foster positive vendor relationships.

Simplifies Financial Auditing:

Keeps detailed records and documentation of payables, making audits easier and also improving transparency.

Reduces Risk of Errors:

Automated calculations and also structured fields minimize the chances of manual mistakes in financial entries.

Supports Budgeting and Planning:

By tracking expenses and upcoming liabilities, businesses can make more informed financial decisions and also budget effectively.