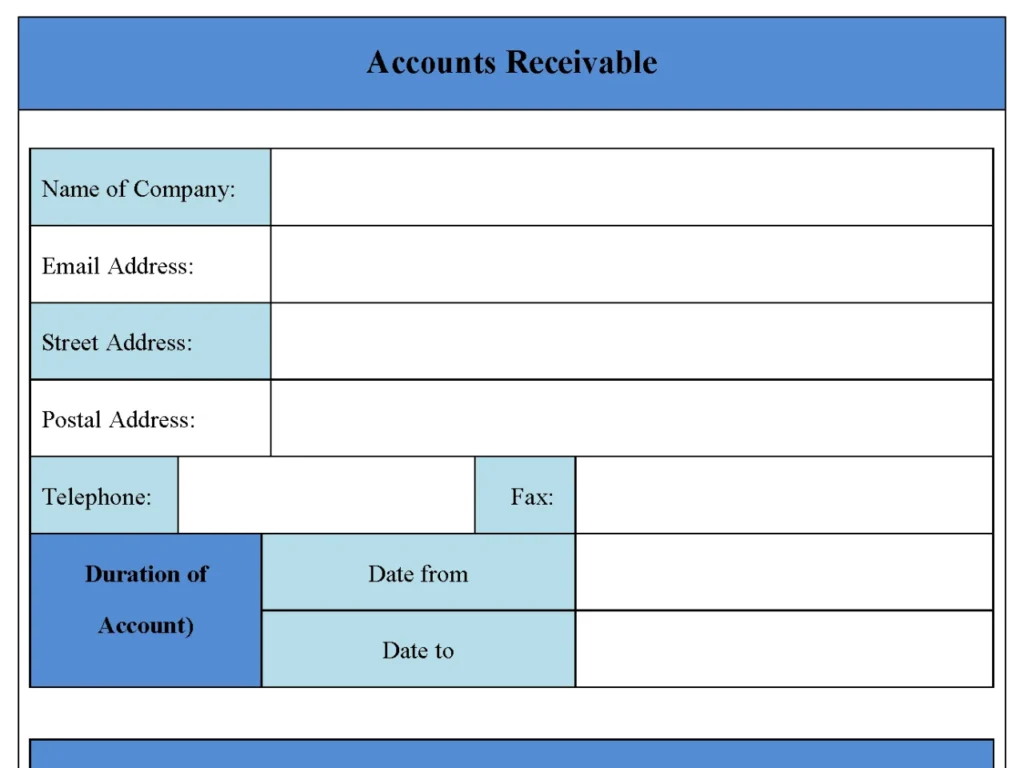

The accounts receivable form also called the aging of account receivable form is used to keep track of your receivable accounts and is used to compliment the account payable form. This form is used to help you identify the accounts not fully paid for and that need further collection activities. Below is a sample accounts receivable form.

You can Download the Accounts Receivable Form post; customize it according to your needs and Print. Accounts Receivable Form is either in MS Word and Editable PDF.

Download Accounts Receivable Form for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Customer and Invoice Tracking:

Provides fields for recording customer information, invoice numbers, dates, and due dates, ensuring comprehensive tracking of receivables.

Payment Status Fields:

Includes options to update payment statuses (e.g., paid, outstanding, overdue), making it easy to monitor outstanding balances.

Aging Report Section:

Allows categorization of receivables by age (e.g., 30, 60, 90 days overdue), helping to prioritize collections.

Automatic Calculation Fields:

Supports automatic computation of totals, balances, and discounts, reducing manual data entry and also potential errors.

Documentation Upload:

Includes space for attaching digital copies of invoices, receipts, and also other supporting documents for centralized recordkeeping.

Benefits:

Enhances Cash Flow Management:

Tracks pending payments and overdue invoices, helping businesses collect revenue promptly and also maintain a healthy cash flow.

Improves Financial Accuracy:

Keeps accurate records of receivables, reducing errors in accounting and facilitating clear financial reporting.

Supports Efficient Collections:

With easy access to aging reports and customer payment histories, businesses can proactively follow up on overdue accounts.

Streamlines Auditing Process:

Organized records and supporting documents simplify audits and also ensure transparency in financial statements.

Strengthens Customer Relationships:

Structured communication about payment statuses helps maintain professional relationships with customers by ensuring clarity and also transparency.