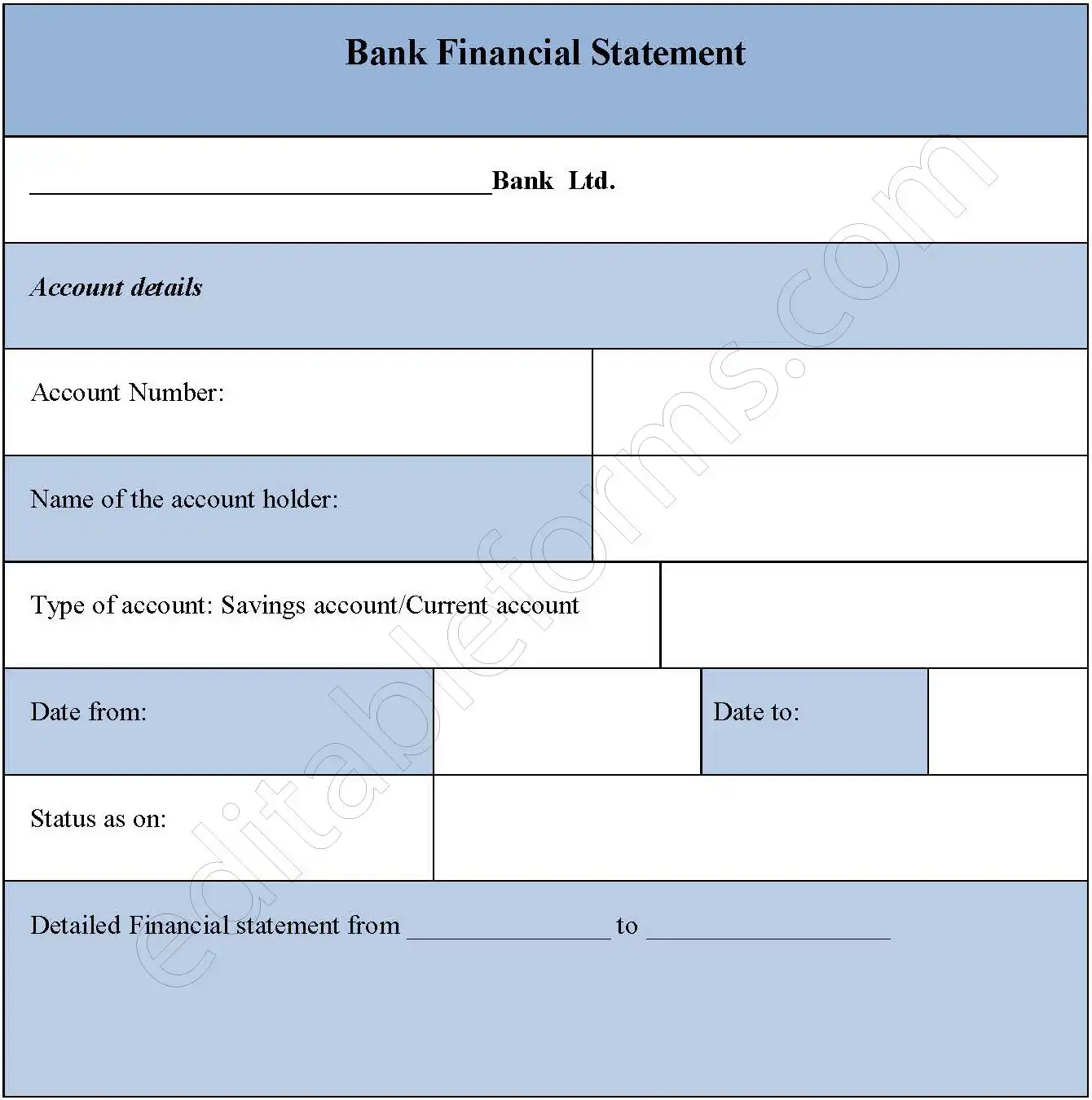

A bank financial statement form is a physical or online method of viewing the account balances of a bank account. This facility is available at the websites of various banks which can be accessed at any point of time. In addition to it, banks send the bank financial statement form periodically to the customers.

You can Download the Bank Financial Statement Template, customize it according to your needs, and Print it. Bank Financial Statement Template is either in MS Word or Editable PDF.

Download the Bank Financial Statement Form Template for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Account Information:

Account number

Holder’s name

Type of account (savings, current, etc.)

Date range covered by the statement

Account Balance:

Opening balance

Closing balance

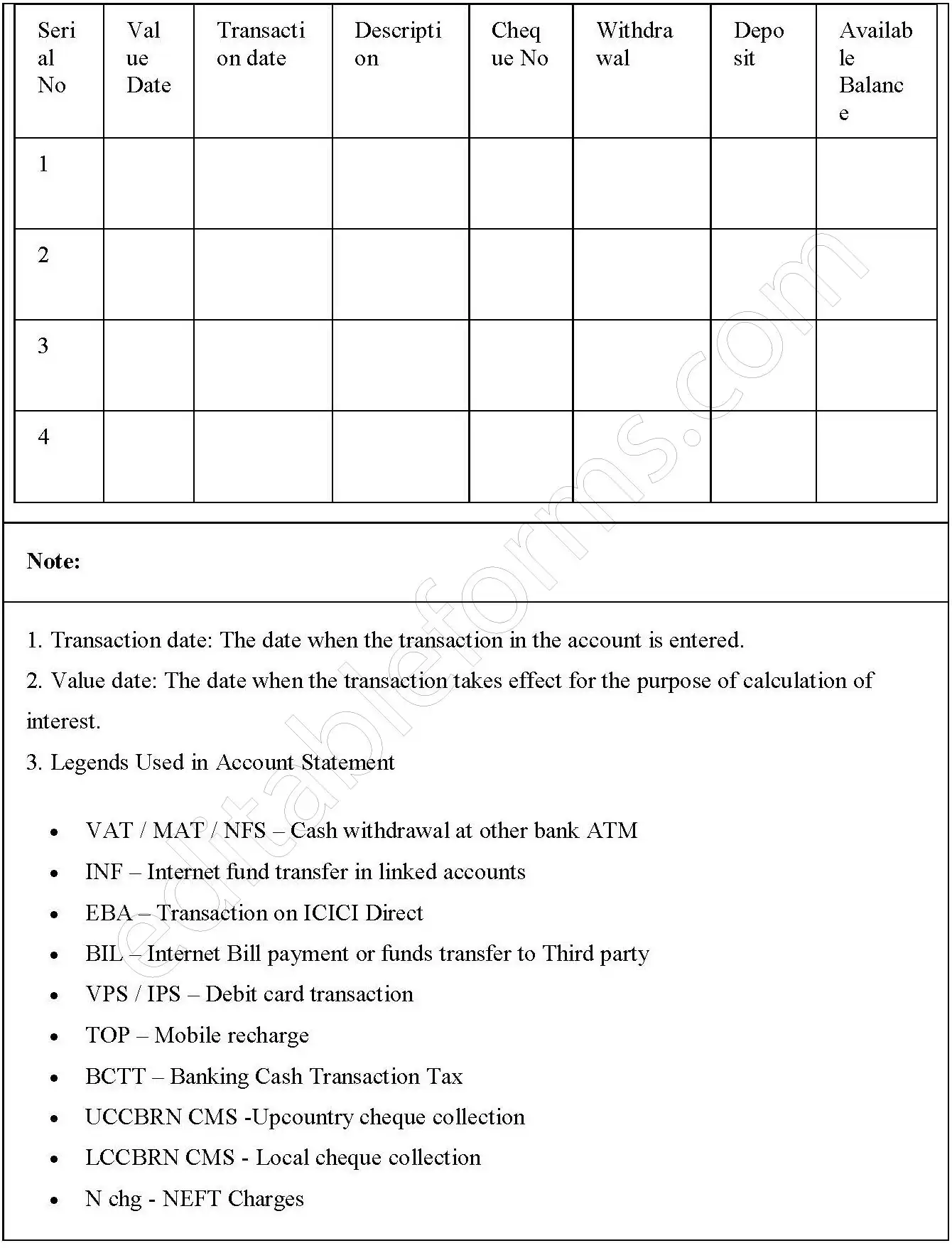

Transaction History:

A detailed list of all transactions, including deposits, withdrawals, transfers, interest earned, and fees charged.

Date of transaction

Description of transaction

Amount (debit or credit)

Account Summary:

A summary of the account’s activity, including total deposits, total withdrawals, total interest earned, total fees charged, and also the net change in the account balance.

Benefits

Standardization:

Ensures consistent formatting and presentation of financial information.

Clarity:

Clearly presents financial data, making it easy to understand and also analyze.

Record Keeping:

Serves as a valuable record of financial transactions and also account activity.

Financial Planning:

Helps individuals and also businesses track their spending and savings habits.

Tax Preparation:

Provides essential information for tax preparation and filing.

Loan Applications:

Can be used to support loan applications by demonstrating financial stability.

Account Reconciliation:

Facilitates the process of reconciling bank statements with personal or business records.