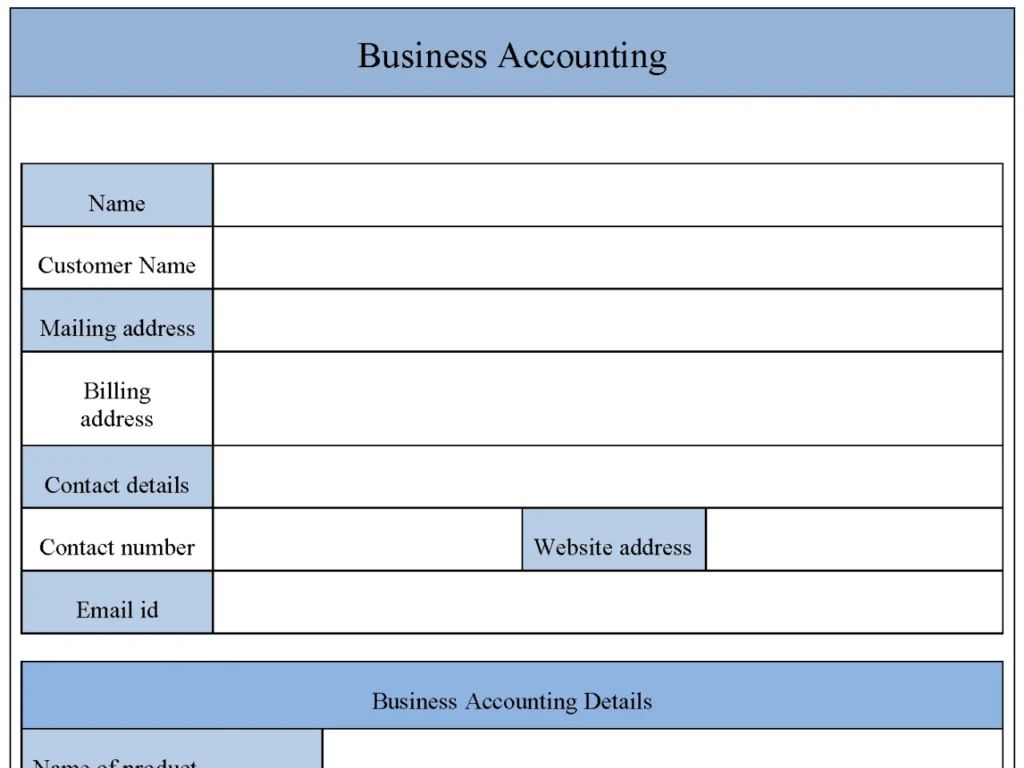

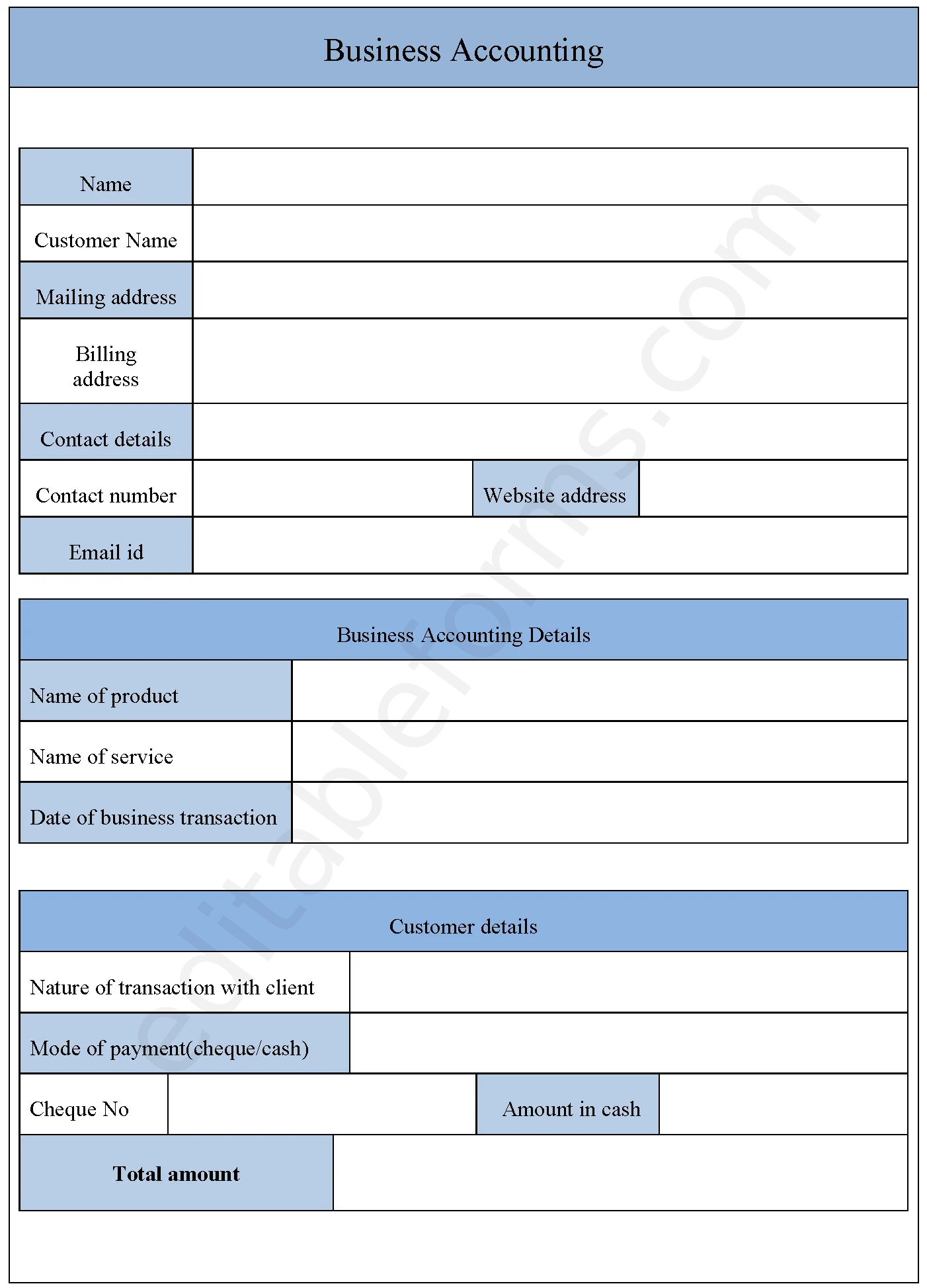

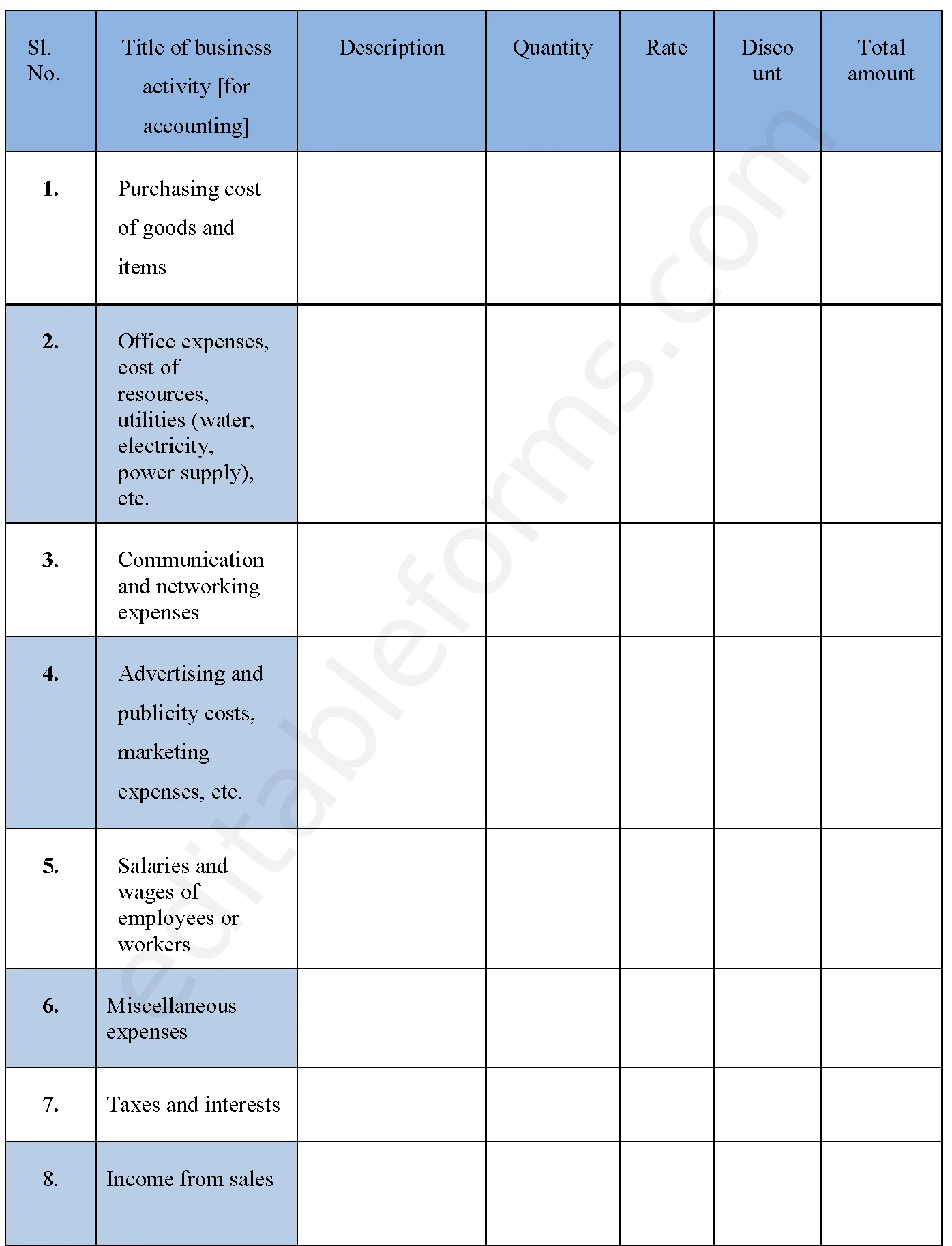

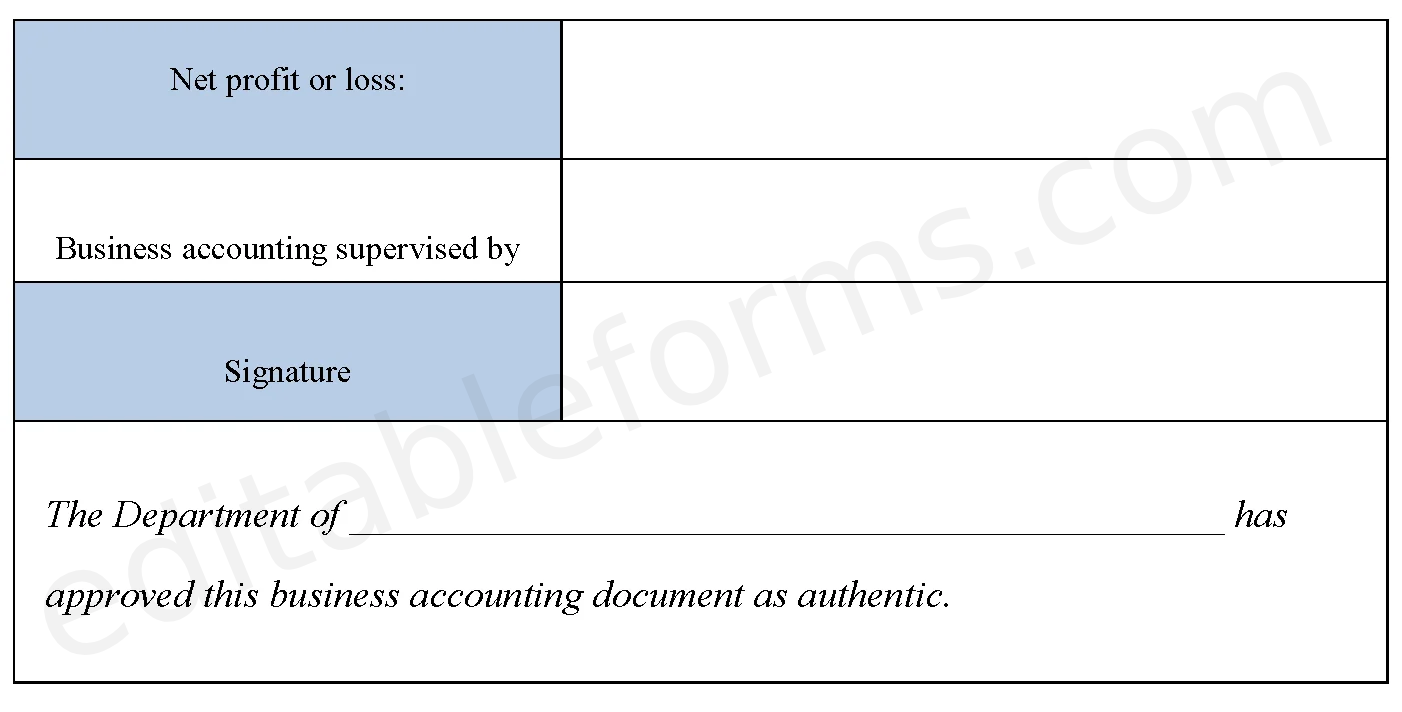

A business accounting form is a document prepared for keeping the records of accounts related to various business transactions. This kind of a form, used for business purposes, must include lineation related to the present transaction status of a particular business account, including the costs incurred, expenses, profit and loss statements, shares, stock market status, debts, etc.

Moreover, this kind of form has to be drafted with precision and effectiveness so that apart from delivering a clear picture of the business account status, it can also serve as a record.

You can Download the Business Accounting Form post; customize it according to your needs and Print. Business Accounting Form is either in MS Word and Editable PDF.

Download Business Accounting Form for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Features

Pre-Formatted Financial Fields:

Includes structured fields for income, expenses, assets, liabilities, and also other essential financial data.

Automated Calculations:

Built-in formulas calculate totals, balances, and also other financial metrics to simplify data analysis.

Customizable Categories:

Easily adjust categories for specific business needs, such as different revenue streams or expense types.

Data Validation:

Ensures accuracy with checks for common accounting errors, reducing discrepancies.

Secure Digital Storage:

Provides a secure, organized location for sensitive financial data with options for password protection and also encryption.

Multi-Format Compatibility:

Works across devices and platforms, enabling data entry from desktops, tablets, or smartphones.

Benefits

Improves Financial Accuracy:

Automated calculations and also data validation reduce errors, ensuring precise accounting records.

Saves Time and Resources:

Speeds up data entry, analysis, and also reporting, freeing up valuable time for accountants and business owners.

Enhances Financial Tracking:

Facilitates clear tracking of revenue, expenses, and also profitability, giving a detailed financial overview.

Simplifies Compliance:

Organizes data in a way that aligns with accounting standards, easing compliance with tax regulations.

Eco-Friendly:

Digital forms eliminate the need for printed documents, supporting sustainable business practices.