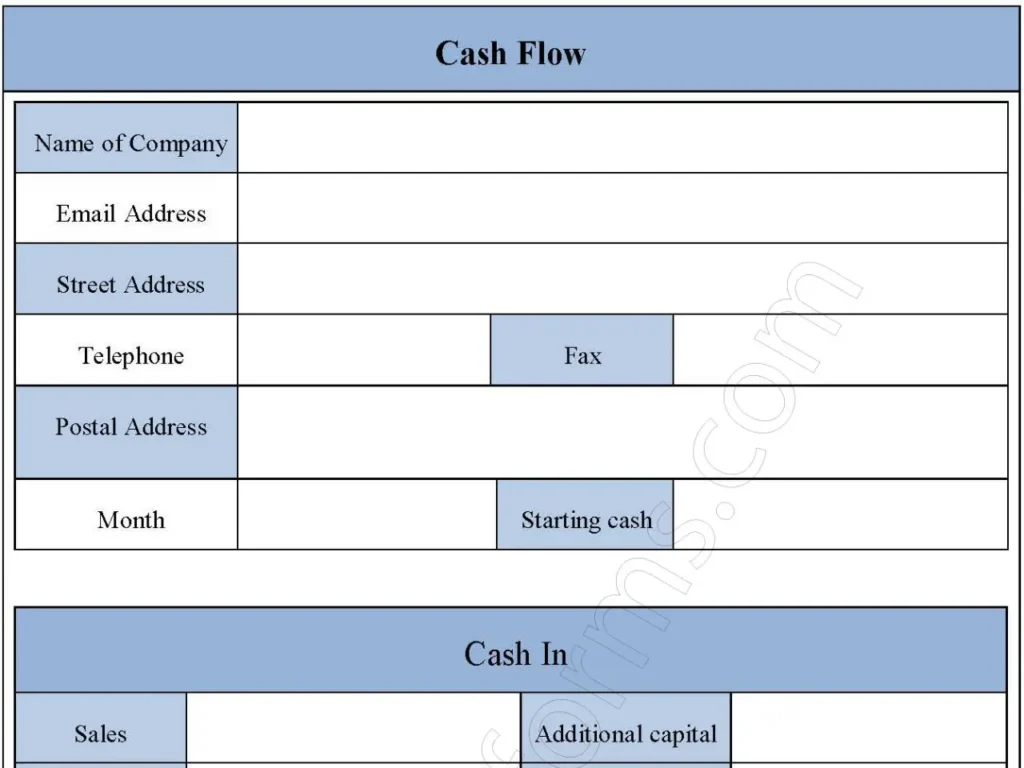

The cash flow form is used to monitor money coming in and money going out of your business. The cash flow gives you the amount of cash projected by the end of each designated period of time usually yearly quarters. For each month you start with the money at hand then add items that bring the cash IN then subtract items of cash OUT. Below is a sample cash flow form.

You can Download the Profit and Loss Form, customize it according to your needs and Print. Profit and Loss Form Template is either in MS Word, or Editable PDF.

Download the Cash Flow Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Income and Expense Sections:

Clearly divided sections for incoming cash and also outgoing expenses, offering a structured view of financial activity.

Monthly and Annual Tracking:

Allows for both monthly and also annual cash flow monitoring, enabling users to track trends over different periods.

Predefined Categories:

Includes common categories for income (sales, investments) and also expenses (rent, utilities, payroll), making it easy to categorize transactions.

Automated Calculations:

Built-in formulas for total cash inflows, outflows, and net cash flow, saving time and also reducing manual calculation errors.

Customizable Fields:

Adaptable to fit specific business or personal needs, with editable fields for unique income or expense types.

Benefits:

Improved Financial Planning:

Provides a clear overview of cash movements, helping users plan and also budget more effectively.

Enhanced Decision-Making:

Helps identify cash surpluses or shortfalls, enabling informed decisions to ensure financial stability.

Efficient Expense Management:

Offers insights into where cash is going, helping businesses control costs and also optimize resource allocation.

Reduced Errors:

Minimizes manual input mistakes by providing a structured template with automated calculations, ensuring data accuracy.

Supports Growth and Investment:

By providing clarity on cash availability, the form supports better planning for investments or expansion.