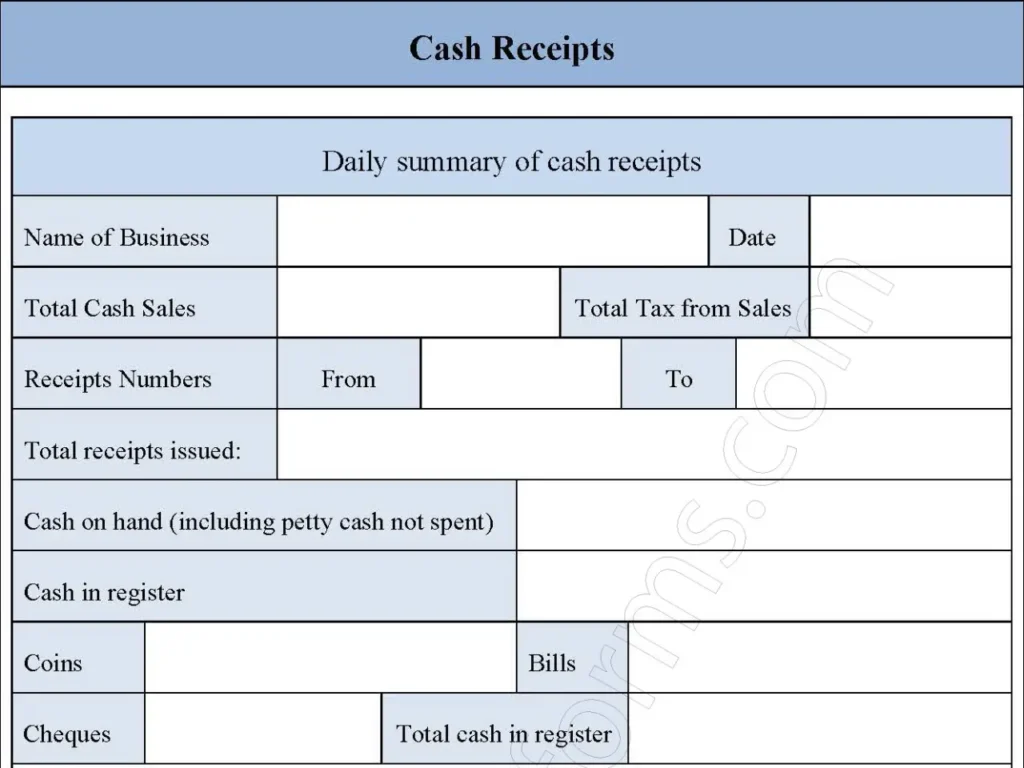

A cash receipt form is used to monitor all cash that comes in daily to a business and all the receipts issued out on a particular day. The cash receipt form is used to record all money that gets in a business and should be filled in daily. Below is a sample cash receipts form.

You can Download the Cash Receipts Form, customize it according to your needs and Print. Cash Receipts Form Template is either in MS Word and Editable PDF.

Download the Cash Receipts Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Date of Receipt:

Records the exact date the payment was received, providing a clear timeline for financial transactions.

Source of Payment:

Identifies the person or entity making the payment, ensuring accountability.

Amount Received:

Details the exact amount of money received, whether in cash, check, or electronic payment.

Payment Method:

Specifies how the payment was made (e.g., cash, check, bank transfer, credit card).

Transaction Reference Number:

Includes a unique reference number or receipt number for easy tracking and record-keeping.

Description or Purpose of Payment:

Notes the reason for the payment, helping to categorize the transaction (e.g., invoice payment, donation).

Authorized Signature:

A space for the receiver to sign, verifying that the payment was received and processed.

Additional Notes:

Allows for any relevant remarks or additional information regarding the transaction.

Benefits:

Accurate Record-Keeping:

Helps ensure that all incoming payments are accurately recorded, making it easier to track cash flow and manage financial records.

Improved Transparency:

Provides clear documentation for auditing purposes, ensuring that all receipts can be verified if necessary.

Fraud Prevention:

Reduces the risk of fraud by providing a clear paper trail of received payments, including signatures and transaction details.

Efficient Reconciliation:

Helps in reconciling bank statements, cash registers, or financial ledgers by matching physical receipts with actual transactions.

Streamlined Financial Reporting:

Facilitates quick and easy reporting of all cash inflows, which is useful for financial analysis and preparing tax reports.

Legal Protection:

Can serve as a legal document in case of disputes or discrepancies regarding payments or transactions.

Audit Trail:

Creates a clear audit trail for auditors, tax authorities, or internal reviews, ensuring compliance with financial regulations.