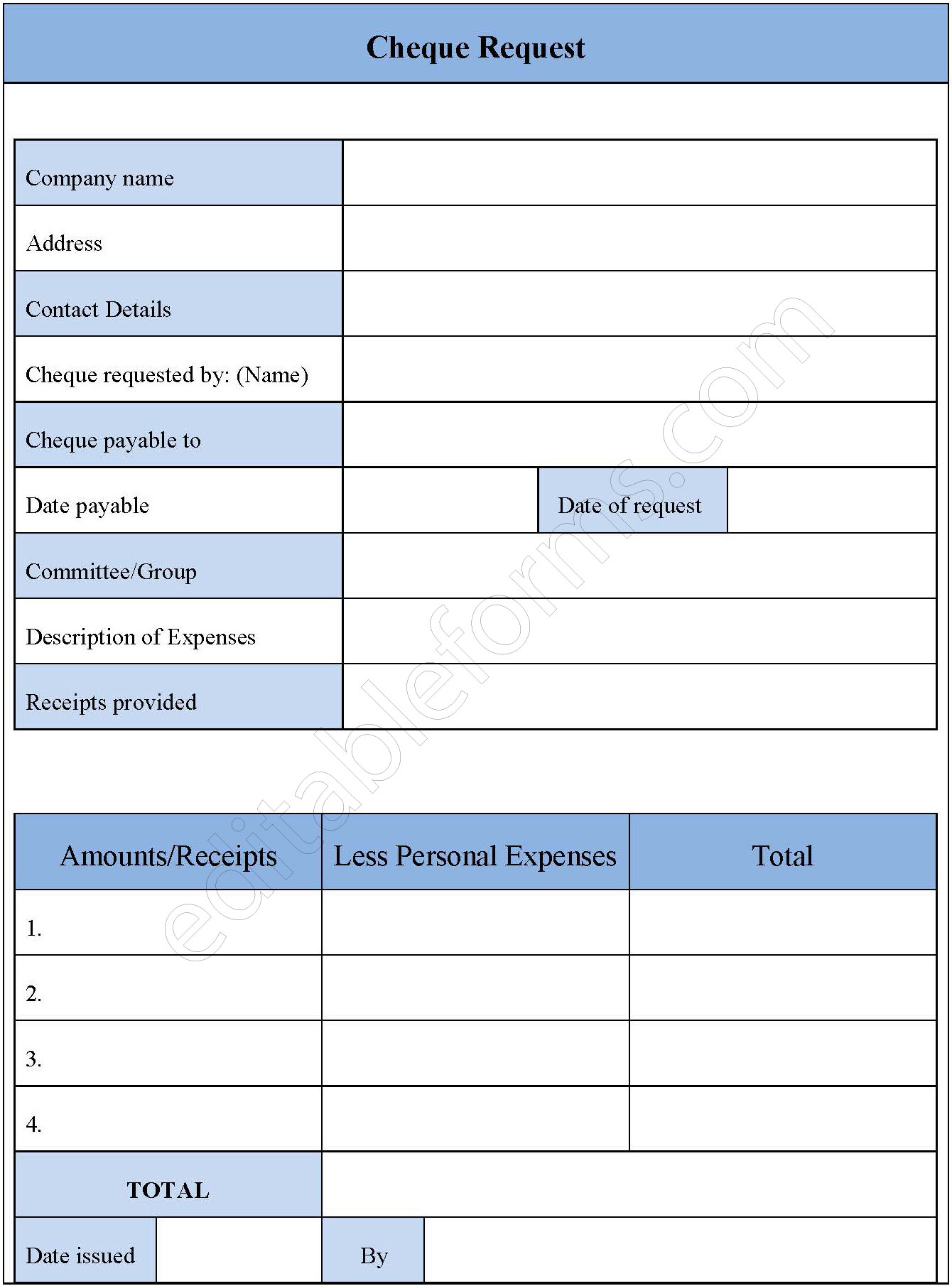

A cheque request form is used for various purposes which include issuing a cheque for payment of a future expense. This form is used to authorize the final payments which need to be made by a certain date. This form gives the description of the cheque in terms of amount to be paid, date, payee and also cheque number. Below is a sample cheque request form.

You can Download the Cheque Request Form Template, customize it according to your needs and Print. Cheque Request Form Template is either in MS Word and in Editable PDF.

Download the Cheque Request Form for only $6.54

Buy Now: 6.54 USD

[paiddownloads id=”296″]

If you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Customizable Fields:

Allows users to specify essential details, including requestor information, cheque amount, payee details, and also purpose of the payment, enabling easy personalization to meet specific requirements.

Approval Workflow:

Includes options for multiple levels of authorization to ensure financial control and compliance.

Automatic Date Stamping:

Records submission and approval dates automatically, and record-keeping.

Secure Data Handling:

Designed with encryption and also access restrictions to protect sensitive financial information.

Digital Signatures:

Supports e-signatures, allowing seamless approval without needing a physical document.

Benefits:

Enhanced Accuracy:

Minimizes errors by providing a structured format, reducing manual entry mistakes in payment processing.

Time Efficiency:

Streamlines the cheque request process by consolidating all required information in one form, saving time for both the requestor and also approvers.

Improved Compliance:

Helps maintain audit trails and financial compliance through clear records of requests and approvals.

Cost Savings:

Reduces the need for physical paperwork, cutting down on administrative costs and also storage needs.

Enhanced Financial Oversight:

Supports better cash flow management by providing clear documentation for cheque requests and also payments.