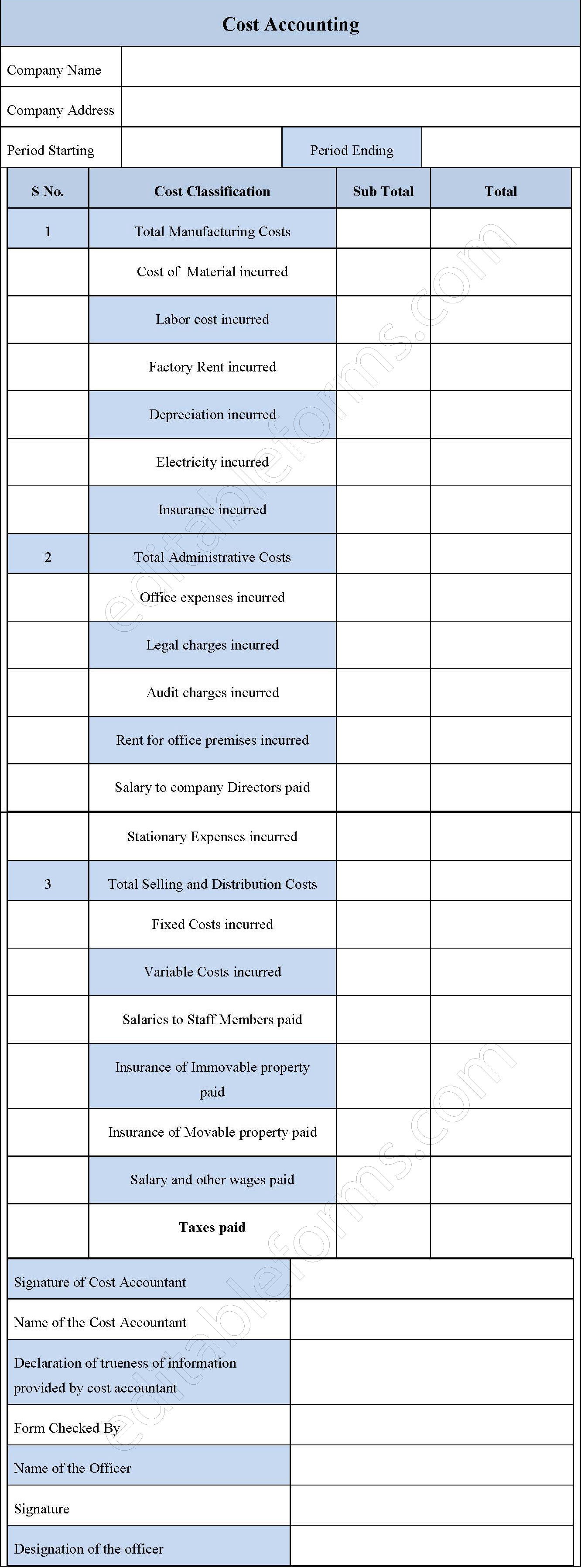

A cost accounting form has all the details that provide the information on the various kinds of expenses incurred by a company. The cost incurred by the company is also known as overhead costs which are classified into factory costs, office costs and lastly selling and distribution costs. It is with the help of a cost accounting form can a company ascertain the cost of production and thereby arrive at the actual profit. This form has to be submitted by all the registered companies compulsorily to the respective government authority every financial year.

You can Download the Free Cost Accounting Form, customize it according to your needs and Print. Cost Accounting Form is either in MS Word and Editable PDF.

Download the Cost Accounting Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Cost Categories:

Breaks down costs into specific categories like direct materials, direct labor, and manufacturing overhead for detailed expense tracking.

Variance Analysis:

Provides space for analyzing cost variances, identifying discrepancies between budgeted and actual spending.

Overhead Allocation:

Includes fields for assigning and tracking overhead costs to different production activities or departments.

Profit Margin Calculation:

Calculates profit margins based on cost data, allowing for better financial decision-making.

Benefits:

Enhanced Cost Control:

By tracking and categorizing costs in detail, businesses can identify areas of overspending and adjust spending to improve cost efficiency.

Informed Pricing Strategies:

Provides insight into total production costs, enabling businesses to set profitable yet competitive pricing.

Improved Budgeting Accuracy:

Offers historical cost data and variance insights, which can improve the accuracy of future budgets and cost predictions.

Optimized Resource Allocation:

Helps in identifying cost drivers and inefficiencies, allowing for more strategic allocation of resources.

Higher Profit Margins:

Facilitates profit margin analysis, giving businesses the information needed to adjust costs or processes to increase profitability.

Enhanced Production Planning:

Provides detailed cost and production data, enabling better planning and scheduling for production activities.

Reduced Waste and Loss:

By identifying variances and inefficiencies, businesses can reduce waste, optimize resource use, and minimize financial loss.

Regulatory and Financial Reporting Compliance:

Organizes cost data in a way that supports compliance with financial reporting standards and regulatory requirements.