A credit check authorization forms grants a person permission to check the card holder’s financial capability by requesting a financial report of his credit details.

This form can be filled by anyone with a credit card when required to do so by people they relate with professionally e.g. landlord, employer or a financial institution that intends to have financial dealings with the card holder.

You can Download the Credit Check Authorization Form post; customize it according to your needs and Print. Credit Check Authorization Form is either in MS Word and Editable PDF.

Download Credit Check Authorization Form for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

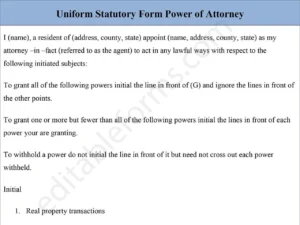

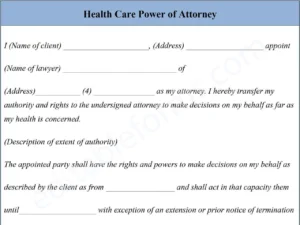

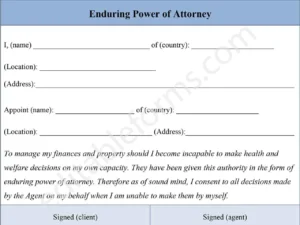

Clear Authorization Statement:

Includes a consent section where the individual acknowledges and authorizes the credit check, ensuring legal compliance.

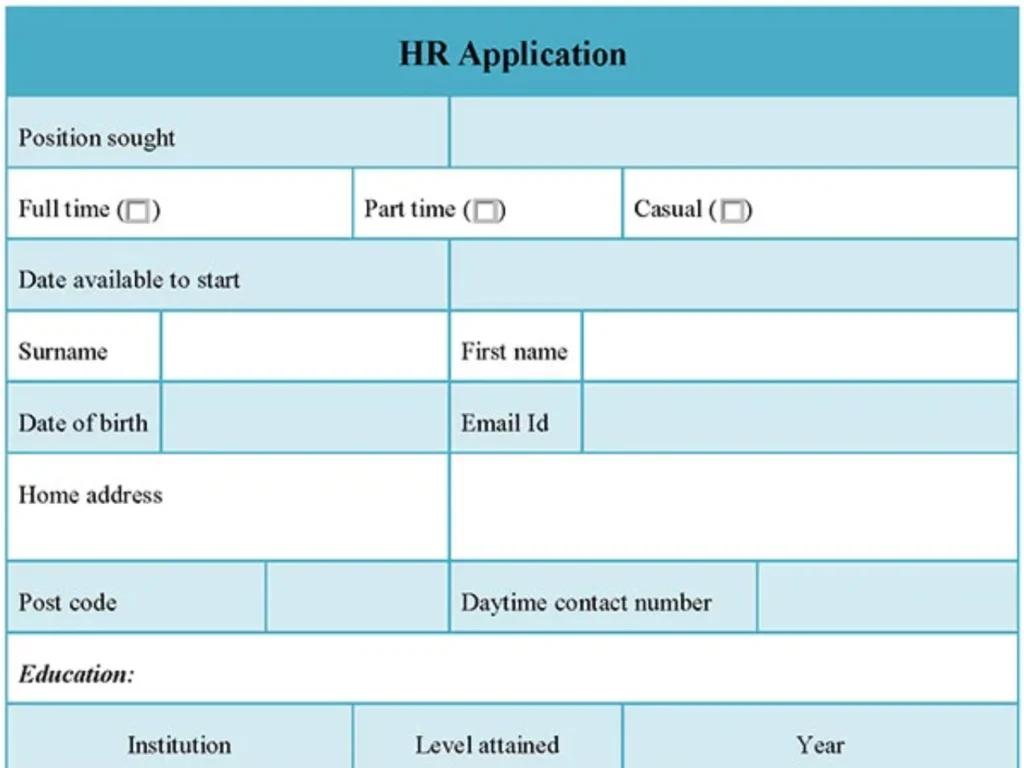

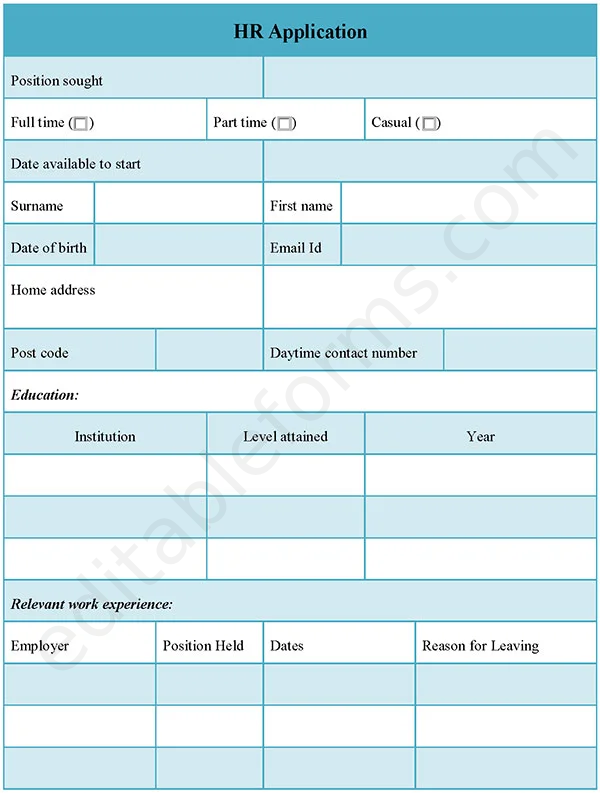

Personal Information Fields:

Collects essential personal details such as name, address, social security number, and date of birth to conduct the credit check accurately.

Scope of Authorization:

Specifies the purpose and extent of the credit check, providing clarity on the process.

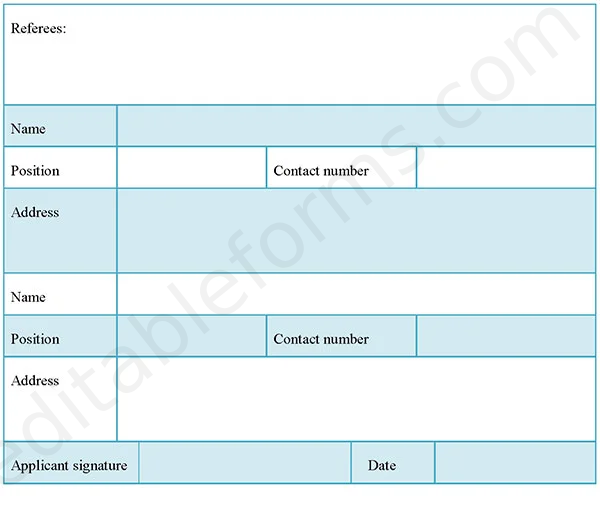

Signature and Date Sections:

Includes fields for the applicant’s signature and also date to validate the authorization.

Privacy and Data Protection Notice:

Outlines how the information will be used and protected, ensuring transparency and also trust.

Digital and Printable Format:

Available as a fillable PDF or printable form for flexibility in collection and also submission.

Benefits:

Legal Compliance:

Ensures that the credit check process is conducted in accordance with relevant laws, such as the Fair Credit Reporting Act (FCRA).

Protects Both Parties:

Secures authorization from the applicant, protecting the business from legal issues while ensuring the applicant’s consent is clear.

Streamlines Credit Check Process:

Simplifies the information gathering process, enabling quicker credit assessments for loan approvals, rentals, or employment purposes.

Enhances Transparency:

Clearly communicates the purpose and scope of the credit check, fostering trust between the business and also the applicant.

Facilitates Record Keeping:

Digital versions of the form make it easier for businesses to store, manage, and also retrieve authorization records for compliance and future reference.

Efficient Risk Management:

Helps businesses assess financial risk by obtaining accurate credit information before making decisions regarding loans, leasing, or employment.