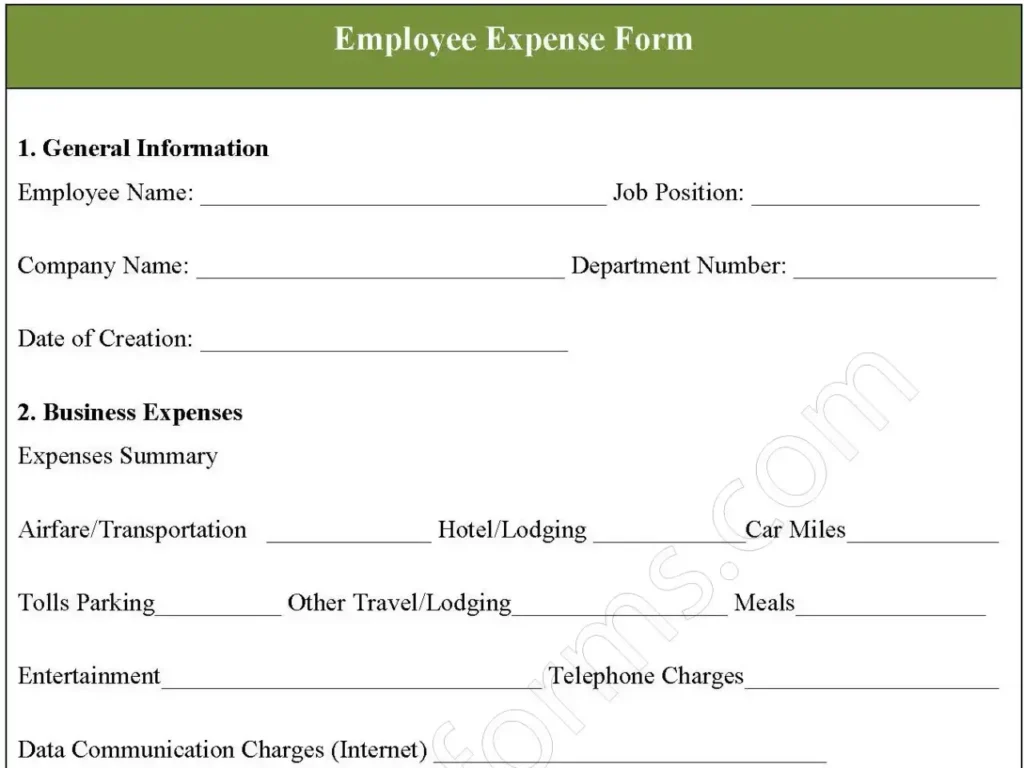

Companies and businesses use the employee expense form to document any expenses incurred by employees on behalf of the company. Whether a company has hundreds of employees or just one employee, an employee expense form saves time, money and simplifies expense tracking. This is a formal document that aims at finding the moneys to be reimbursed to an employee. Below is a sample employee expense form.

You can Download the Employee Expense Template, customize it according to your needs, and Print it. Employee Expense Form Template is either in MS Word or Editable PDF.

Download the Employee Expense Form Template for only $6.54.

If you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

General Information

Employee Details:

Collects the employee’s name, job position, department number, and date of creation of the expense report.

Company Information:

Specifies the company name.

Business Expenses

Expense Categories:

Includes various categories of business expenses, such as:

Airfare/Transportation

Hotel/Lodging

Car Miles

Tolls/Parking

Other Travel/Lodging

Meals

Entertainment

Data Communication Charges (Internet)

Software

Literature/Books

Other

Cost Incurred:

Provides space to record the cost incurred for each expense category.

Total Expenses Incurred:

Calculates the total amount claimed for all expenses.

Signatures and Approvals

Employee Signature:

Requires the employee’s signature to confirm the accuracy of the expenses claimed.

Supervisor Signature:

Requires the supervisor’s signature to approve the expense report.

Authorized Signature:

Requires the signature of an authorized person to authorize the reimbursement.

Benefits

Standardization:

Ensures consistency in the process of submitting and processing expense claims.

Clarity:

Clearly outlines the information required to process reimbursement claims.

Efficiency:

Streamlines the reimbursement process by providing a structured format.

Accuracy:

Reduces the risk of errors in calculating reimbursement amounts.

Record Keeping:

Serves as a valuable record of business expenses, which can be important for tax purposes and expense reporting.

Compliance:

Helps organizations comply with expense reimbursement policies and tax regulations.

Employee Satisfaction:

Provides a clear and efficient process for employees to claim reimbursement for business-related expenses.