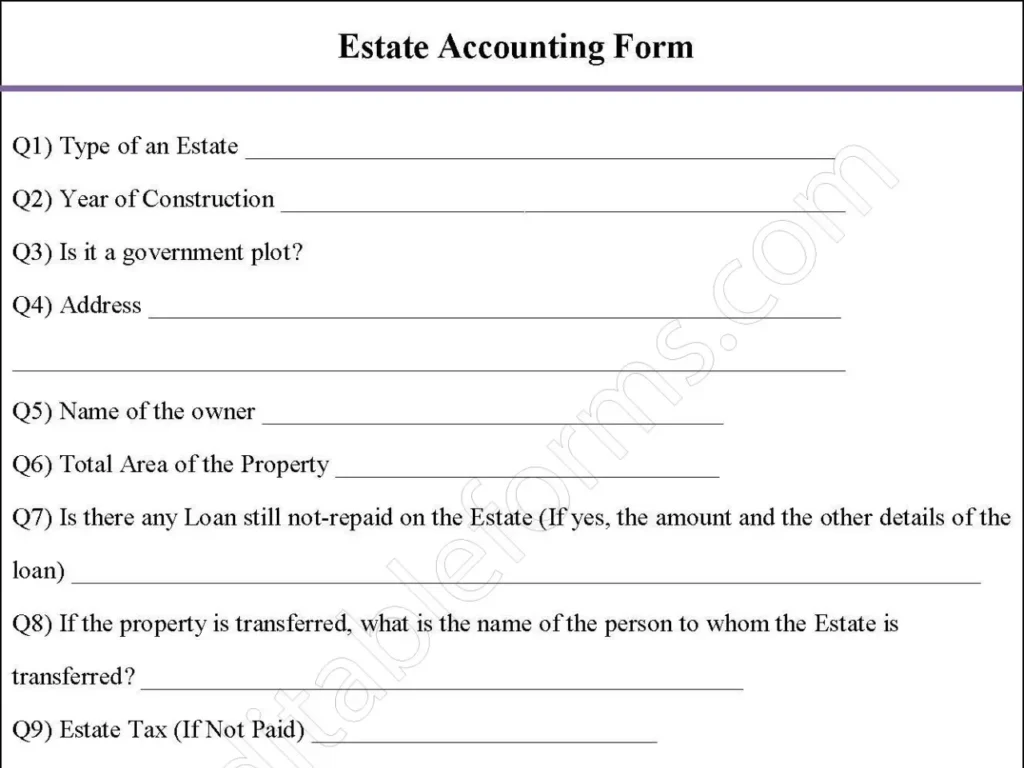

Estate accounting is normally done for settlement of an Estate. Estate Accounting comes into picture when a person dies, and an executor is appointed to keep accurate records and to administer the estate under the probation of the court. Below is a sample Estate Accounting Form. You can Download the Estate Accounting Forms, customize it according to your needs and Print. Estate Accounting Forms Template is either in MS Word and Editable PDF.

Download the Estate Accounting Forms for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Asset Inventory:

Provides fields to list all assets of the estate, including real estate, bank accounts, investments, personal property, and valuables.

Liabilities and Debts:

Includes sections for recording outstanding debts, loans, mortgages, and any other liabilities against the estate.

Expense Documentation:

Records all expenses related to estate administration, including legal fees, maintenance costs, taxes, and also payments to beneficiaries.

Account Balance Updates:

Maintains a running balance of estate funds after each transaction, ensuring transparency in fund management.

Tax Reporting Section:

Offers a dedicated area to record tax payments or refunds associated with the estate, aiding in tax compliance.

Benefits:

Transparency and Accountability:

Ensures executors maintain clear, detailed records of all financial activities, building trust among beneficiaries.

Simplifies Probate Process:

Organizes all necessary financial data in one place, making it easier to present information to the probate court if required.

Reduces Risk of Disputes:

Clear documentation of all transactions can prevent misunderstandings or conflicts among heirs or beneficiaries.

Improves Tax Compliance:

Provides an organized record of income and tax-related transactions, ensuring all tax obligations are met and also properly documented.

Facilitates Accurate Asset Management:

Helps the executor accurately manage estate assets by tracking income and also expenses, supporting efficient estate administration.

Supports Estate Planning:

Gives estate planners a clear financial overview, which is beneficial for making informed decisions and also adjustments to the estate plan.

Streamlines Final Settlement:

Simplifies the final distribution process by clearly showing what funds and assets are left for beneficiaries, facilitating smooth estate closure.

Enhances Legal Protection:

Provides a clear audit trail for executors, minimizing the risk of legal issues or accusations of mismanagement.