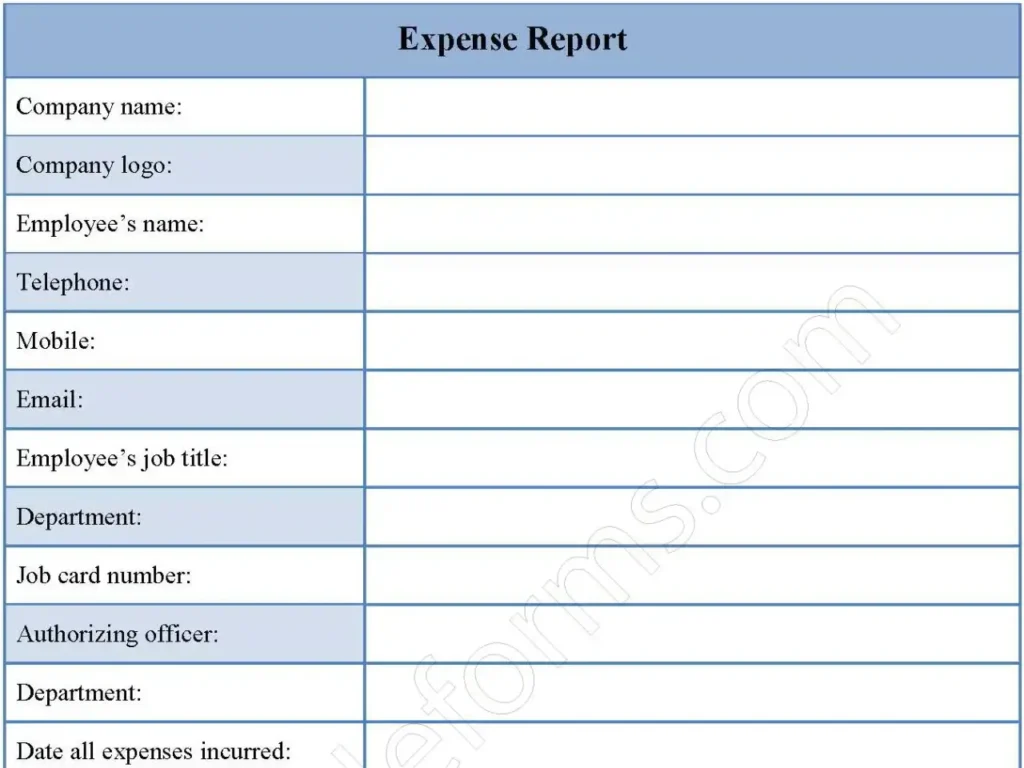

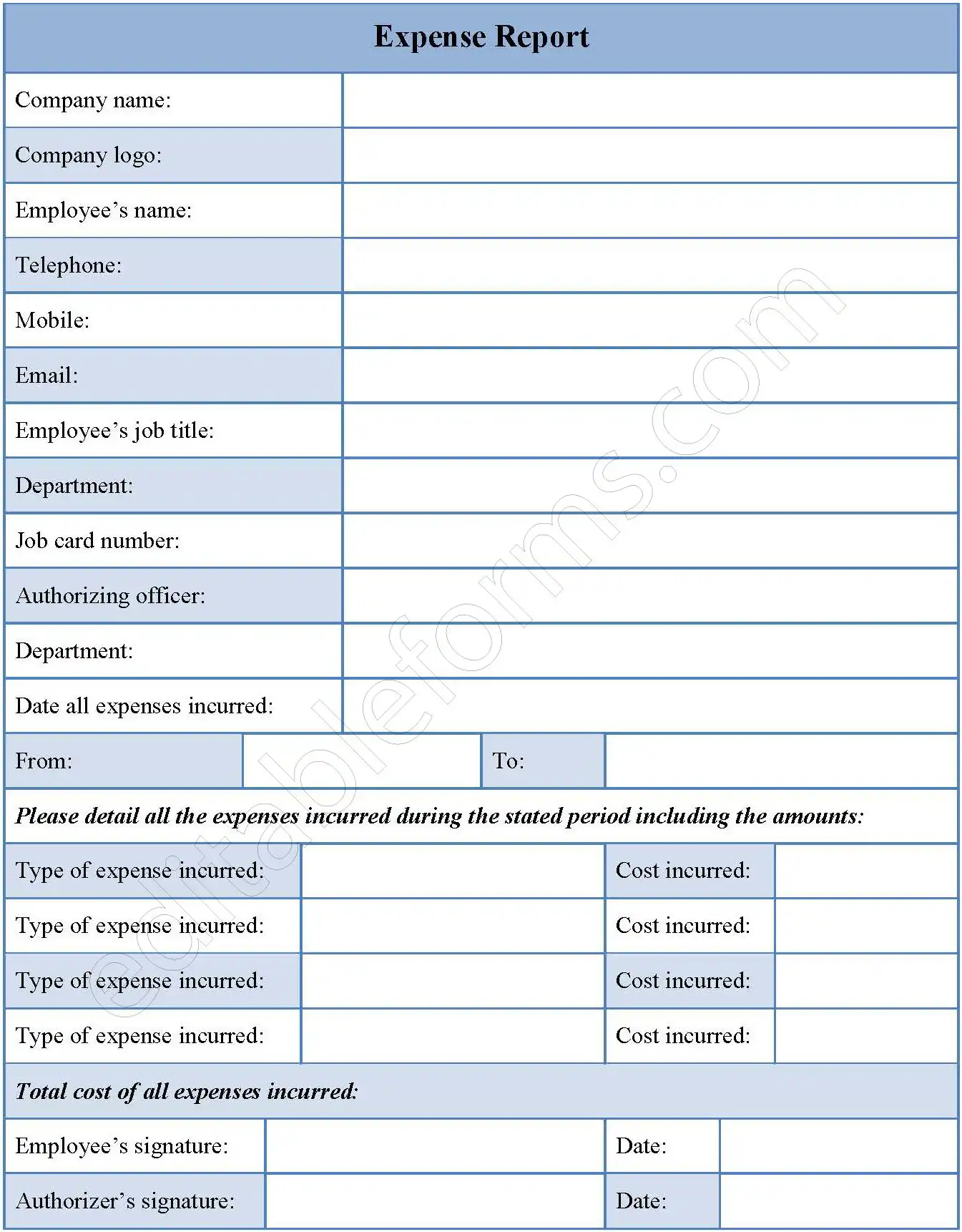

The expense report form template can be used by any company that wants to come up with their own format of documenting all expenses incurred by their staff while on official duty. The template can be used as an example about the kind of information that should be included and recorded.

You can Download the Expense Report Form Template, customize it according to your needs, and Print it.Expense Report Form Template is either in MS Word or Editable PDF.

Download the Expense Report Form Template for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Employee Information:

Collects basic details like the employee’s name, job title, department, and also contact information.

Trip Details:

Asks for the date of departure, flight number, airline, destination, date of arrival, hotel name, days spent at the hotel, and also date of return.

Expense Categories:

Includes sections to record expenses for:

Transportation:

Airfare, train tickets, bus tickets, car rentals, and also taxi fares.

Accommodation:

Hotel or accommodation costs.

Meals and Entertainment:

Expenses for meals, snacks, and also entertainment related to business activities.

Communication Costs:

Phone calls, internet usage, and also other communication expenses.

Total Expenses:

Calculates the total amount claimed for the trip.

Signature and Approval:

Requires the employee’s signature and the approval of their supervisor or manager.

Benefits

Standardization:

Ensures consistency in the process of submitting and also processing travel expense claims.

Clarity:

Clearly outlines the information required to process reimbursement claims.

Efficiency:

Streamlines the reimbursement process by providing a structured format.

Accuracy:

Reduces the risk of errors in calculating reimbursement amounts.

Record Keeping:

Serves as a valuable record of travel expenses, which can be important for tax purposes and also expense reporting.

Compliance:

Helps organizations comply with expense reimbursement policies and also tax regulations.

Employee Satisfaction:

Provides a clear and efficient process for employees to claim reimbursement for business-related expenses.