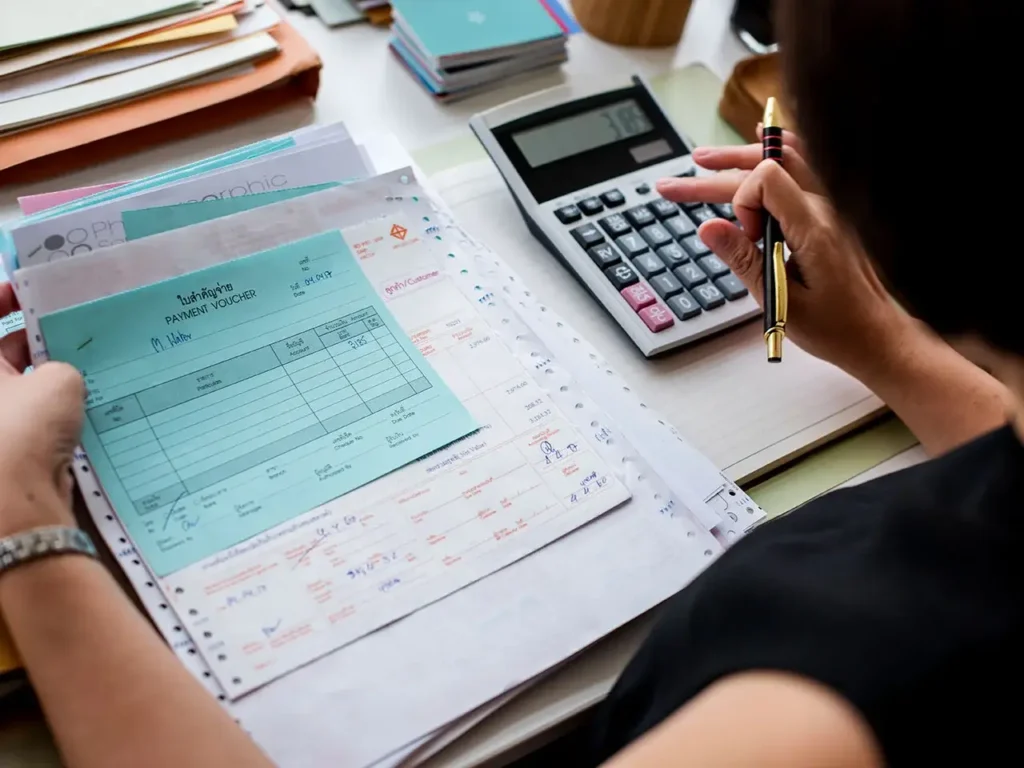

Running a small business can be a lot of work, and keeping track of your finances is just one of the many tasks that you need to stay on top of. That’s where fillable accounting form in pdf come in. These forms help you track your income and also expenses, create invoices, and also manage your inventory.

In this blog post, we will discuss the benefits of using fillable accounting form in pdf, and provide a list of some of the most common and also useful forms. and also give you some tips on how to use these forms effectively.

Benefits of Using Fillable Accounting Forms:

There are many benefits to using fillable accounting forms. Here are just a few:

They can save you time and effort.

Fillable forms can be filled out electronically, which means that you don’t have to waste time handwriting them. This can save you a lot of time, especially if you have a lot of transactions to track.

They are more accurate.

When you fill out a form electronically, there is less chance of making a mistake. This is because the computer will automatically calculate the totals for you.

They are more secure.

Fillable forms can be password-protected, which means that your financial information is more secure.

They are easy to share.

If you need to share your financial information with someone else, you can easily email or fax a fillable form.

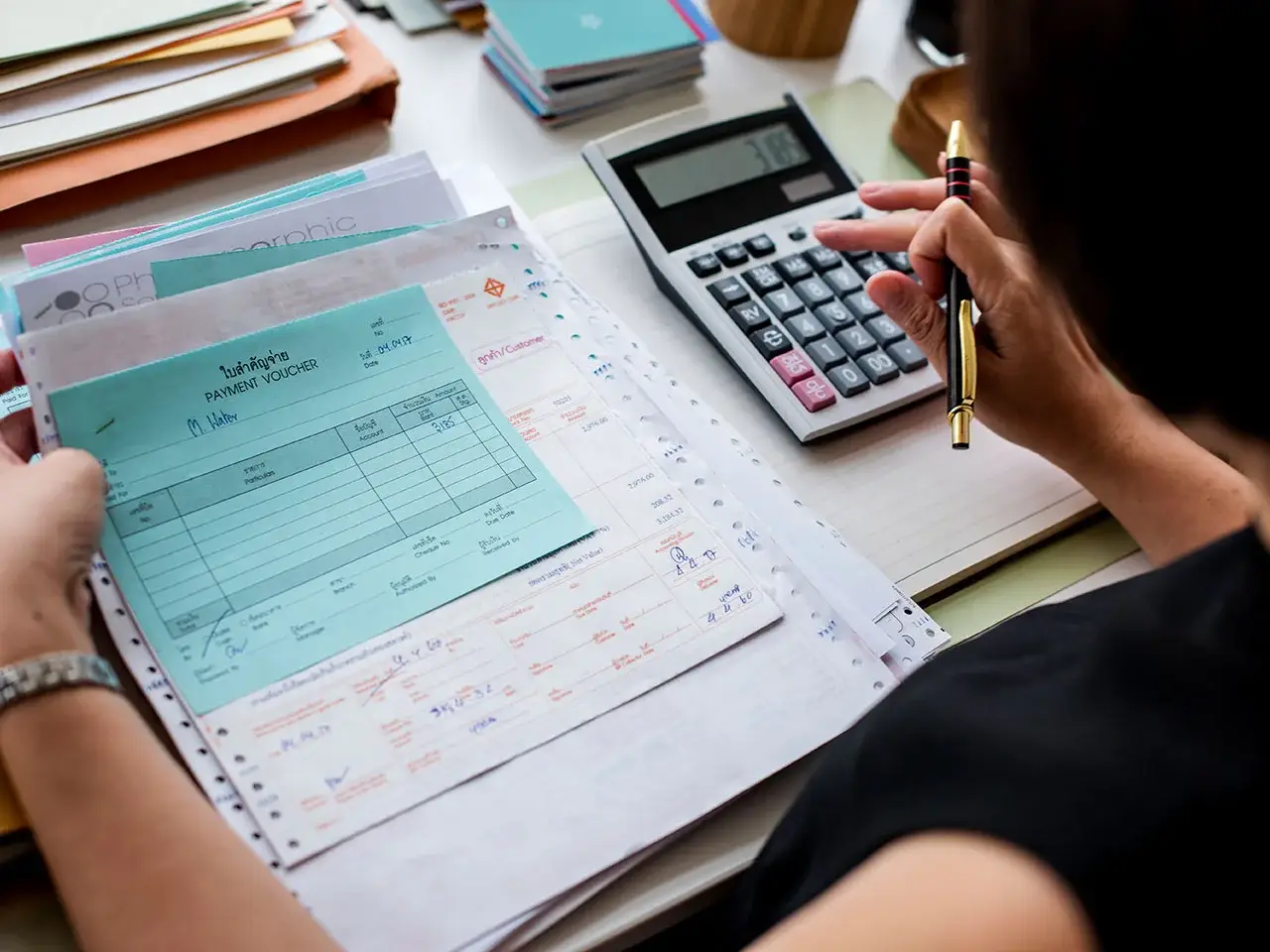

Common and Useful Accounting Forms:

There are many different types of accounting forms, but some of the most common and useful ones include:

Invoices:

Invoices are used to bill customers for goods or services. They typically include the customer’s name, address, and also contact information, as well as the details of the transaction.

Receipts:

Receipts are used to document purchases. They typically include the date, amount, and also description of the purchase.

Bank reconciliation forms:

Bank reconciliation forms are used to reconcile your bank account balance with your accounting records. They typically include the bank statement balance, the cashbook balance, and any outstanding transactions.

Petty cash forms:

Petty cash forms are used to track petty cash expenditures. They typically include the date, amount, and also purpose of the expenditure.

Inventory tracking forms:

Inventory tracking forms are used to track the quantity and also value of your inventory. They typically include the item name, quantity, unit cost, and also total value.

Tips for Using Fillable Accounting Forms:

Here are a few tips for using fillable accounting forms effectively:

Use a consistent format.

This will make it easier to find and also track your information.

Use clear and concise language.

This will help to avoid confusion.

Include all of the necessary information.

This will ensure that your forms are accurate and also complete.

Save your forms in a safe place.

This will protect your financial information.

Conclusion:

Fillable accounting forms valuable tool for small businesses. They can help you to save time, improve accuracy, and also protect your financial information. If you are not already using fillable accounting forms, I encourage you to give them a try. You can surprised at how much they can help you.