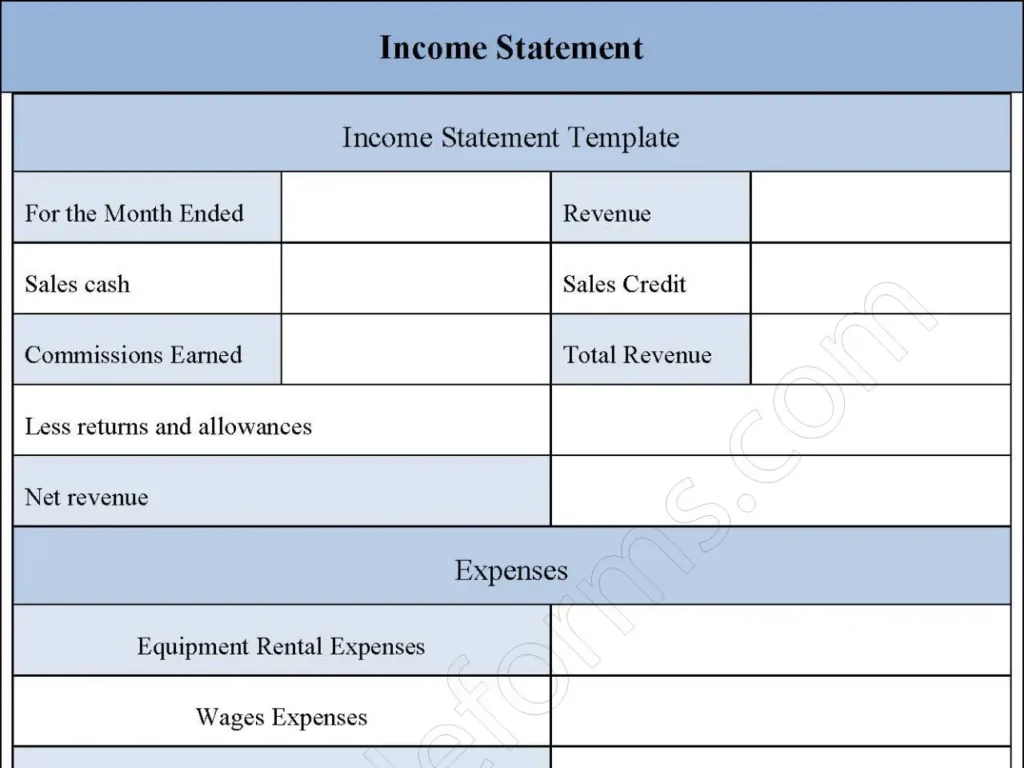

An income statement form is a summary of earnings and expenses received and incurred by a company. It is issued every financial year or as otherwise stated by the organization’s policy. This form is completed by the organizations qualified and competent accountant. It is paramount to keep track of all incomes and expenses to make it easy to come up with a balance sheet. It itemizes the revenues and expenses of the past that led to the current profit or loss, and indicates what may be done to improve the results. Below is a sample income statement form.

You can Download the Income Statement Form, customize it according to your needs and Print. Income Statement Form Template is either in MS Word and in Editable PDF.

Download the Income Statement Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Revenue Section:

Lists all income sources, including sales revenue, service revenue, and also other income, providing a breakdown of earnings.

Cost of Goods Sold (COGS):

Displays the direct costs associated with producing goods or services, allowing calculation of gross profit.

Gross Profit:

Shows the total revenue minus the cost of goods sold, reflecting profitability before deducting operational expenses.

Operating Expenses:

Details fixed and variable expenses such as salaries, rent, utilities, and also other operating costs, offering a view of essential spending.

Operating Income:

Reveals profit after subtracting operating expenses from gross profit, showing how well the core business operations perform.

Other Income and Expenses:

Includes non-operating items like interest income, gains/losses, and also taxes, providing a comprehensive financial picture.

Net Income:

Summarizes total profit or loss after accounting for all revenue, costs, and also expenses, providing the company’s bottom line.

Comparative Columns:

Allows for period-over-period comparisons (e.g., month-over-month or year-over-year), enabling trend analysis.

Benefits:

Financial Performance Overview:

Provides a snapshot of the company’s profitability, making it easier for management and also investors to assess financial health.

Improved Decision-Making:

Enables stakeholders to make data-driven decisions by showing which areas of the business are most and also least profitable.

Identifies Cost Management Opportunities:

Highlights major expenses, helping management identify and also reduce unnecessary costs to improve net income.

Supports Budgeting and Forecasting:

Assists in creating accurate budgets and forecasts by showing historical performance and also trends.

Facilitates Investor Analysis:

Essential for investors who need to understand the company’s earning power and also growth potential before investing.

Regulatory Compliance:

Helps businesses comply with financial reporting standards and also legal requirements, which is especially crucial for publicly traded companies.

Enables Ratio Analysis:

Useful for calculating financial ratios like gross profit margin, operating margin, and also net profit margin, aiding in business analysis.

Enhances Transparency:

Provides clarity and transparency about income and expenses, which can build trust among stakeholders, employees, and also shareholders.