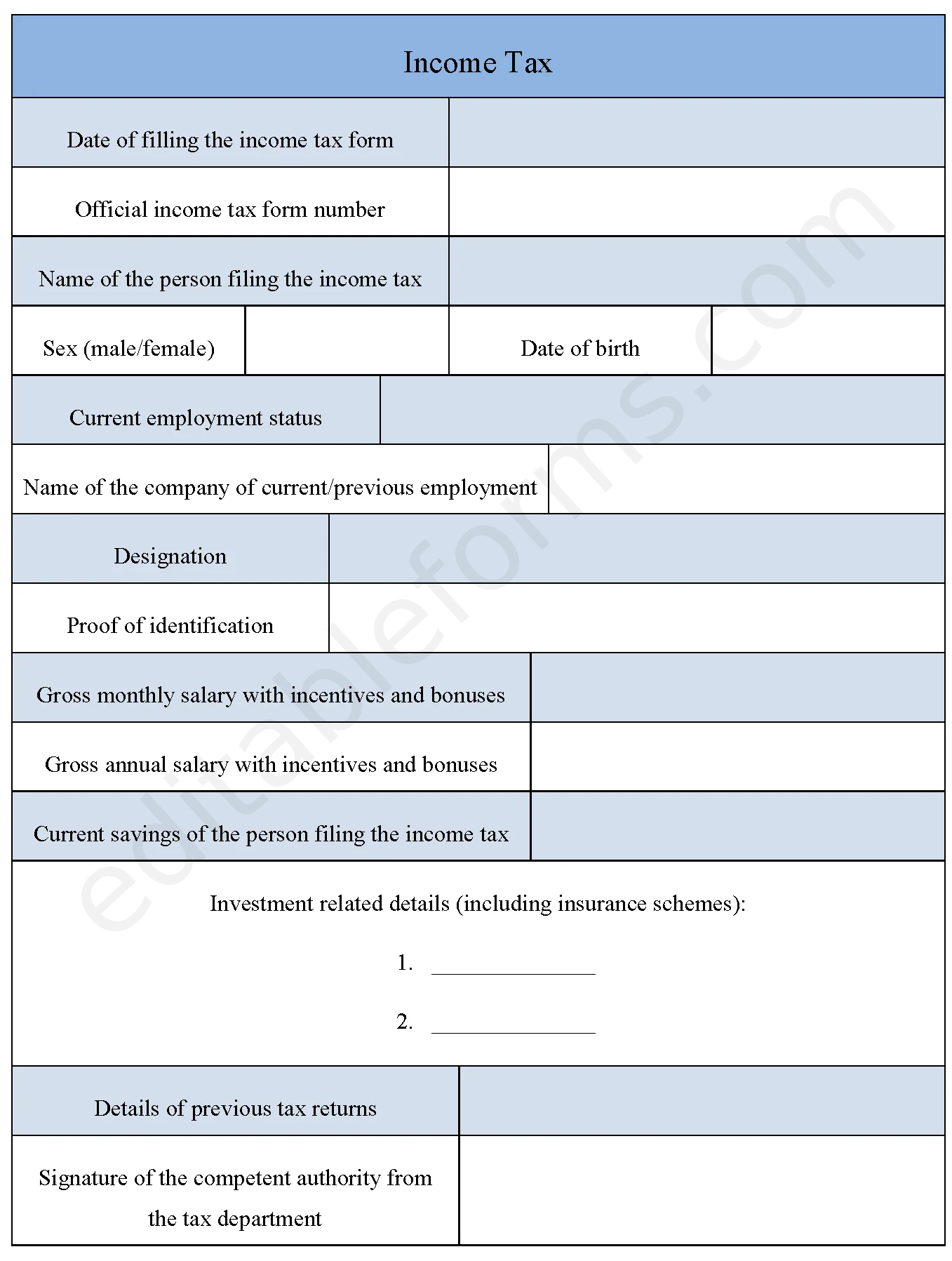

An income tax form, as the name suggests, is a form where the concerned person fills his income and savings details with pertinent information of his/her investments in order to avoid any complication at the time of filing income tax returns with the administrative authority. The income tax form has a prominent legal weight attached to it.

You can Download the Income Tax Form post; customize it according to your needs and Print. Income Tax Form is either in MS Word and Editable PDF.

Download Income Tax Form for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Income Reporting Sections:

Organized fields for reporting various sources of income, such as wages, dividends, interest, and also investments, ensuring accurate income declaration.

Deductions and Credits:

Includes sections for eligible deductions (e.g., student loans, mortgage interest) and also tax credits, which help reduce overall tax liability.

Tax Calculation Tools:

Built-in fields for automatic calculations or guidelines for computing taxable income, tax owed, and also potential refunds.

Filing Status and Dependents:

Provides options for selecting filing status (single, married, etc.) and also declaring dependents, which impact tax rates and credits.

Digital Submission and Payment Options:

Enables electronic filing and payment options, streamlining the submission process and also providing a secure way to handle taxes.

Benefits:

Ensures Compliance with Tax Laws:

The form helps individuals and businesses report income and pay taxes accurately, meeting legal obligations and also avoiding penalties.

Maximizes Tax Savings:

Deductions and credits sections allow taxpayers to claim eligible tax benefits, potentially reducing their tax liability.

Simplifies the Filing Process:

With structured fields and guided sections, the form makes it easier to organize and also report tax information without errors.

Supports Financial Planning:

By reviewing income and deductions, taxpayers gain insights into their finances, helping with budgeting and also future tax planning.

Promotes Efficiency and Convenience:

Digital submission options reduce paperwork, processing times, and also the need for in-person visits, making tax filing faster and also more convenient.