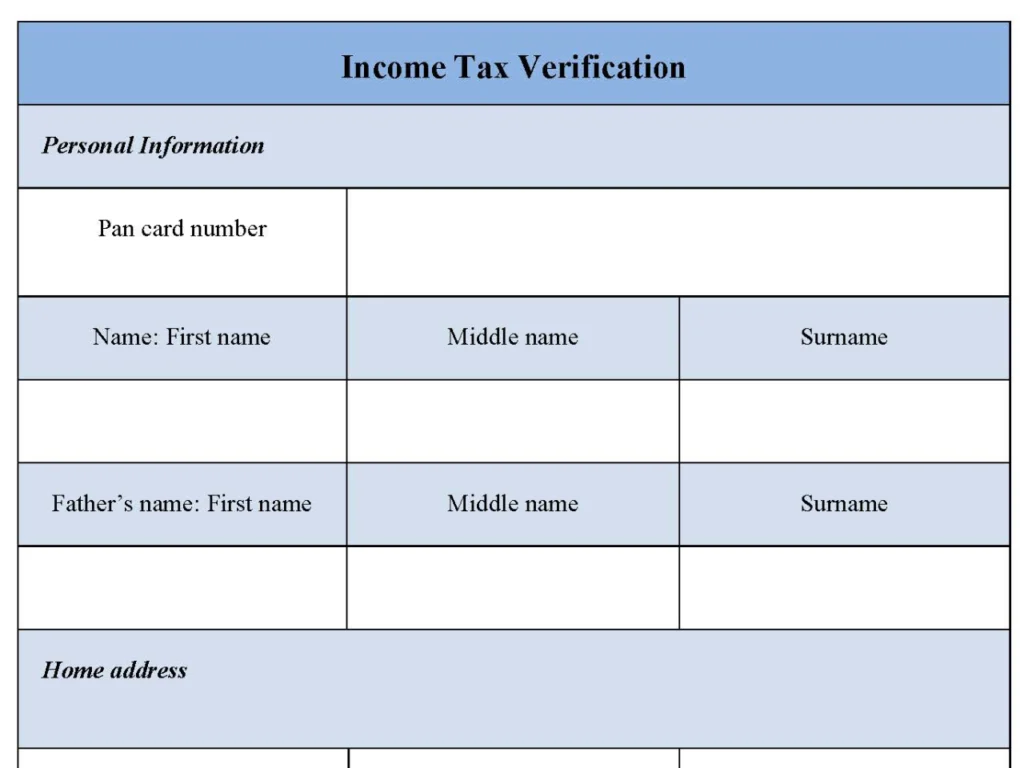

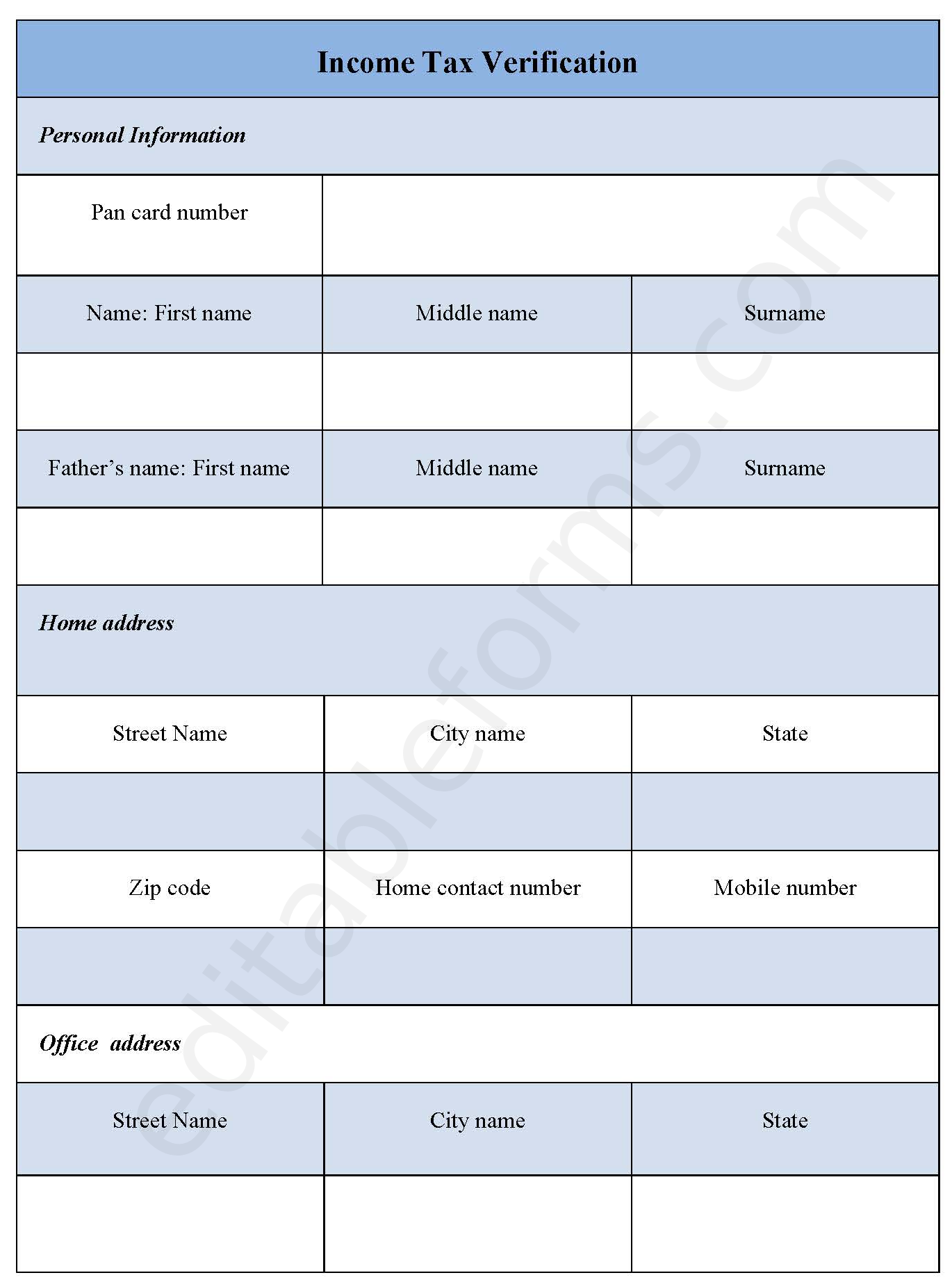

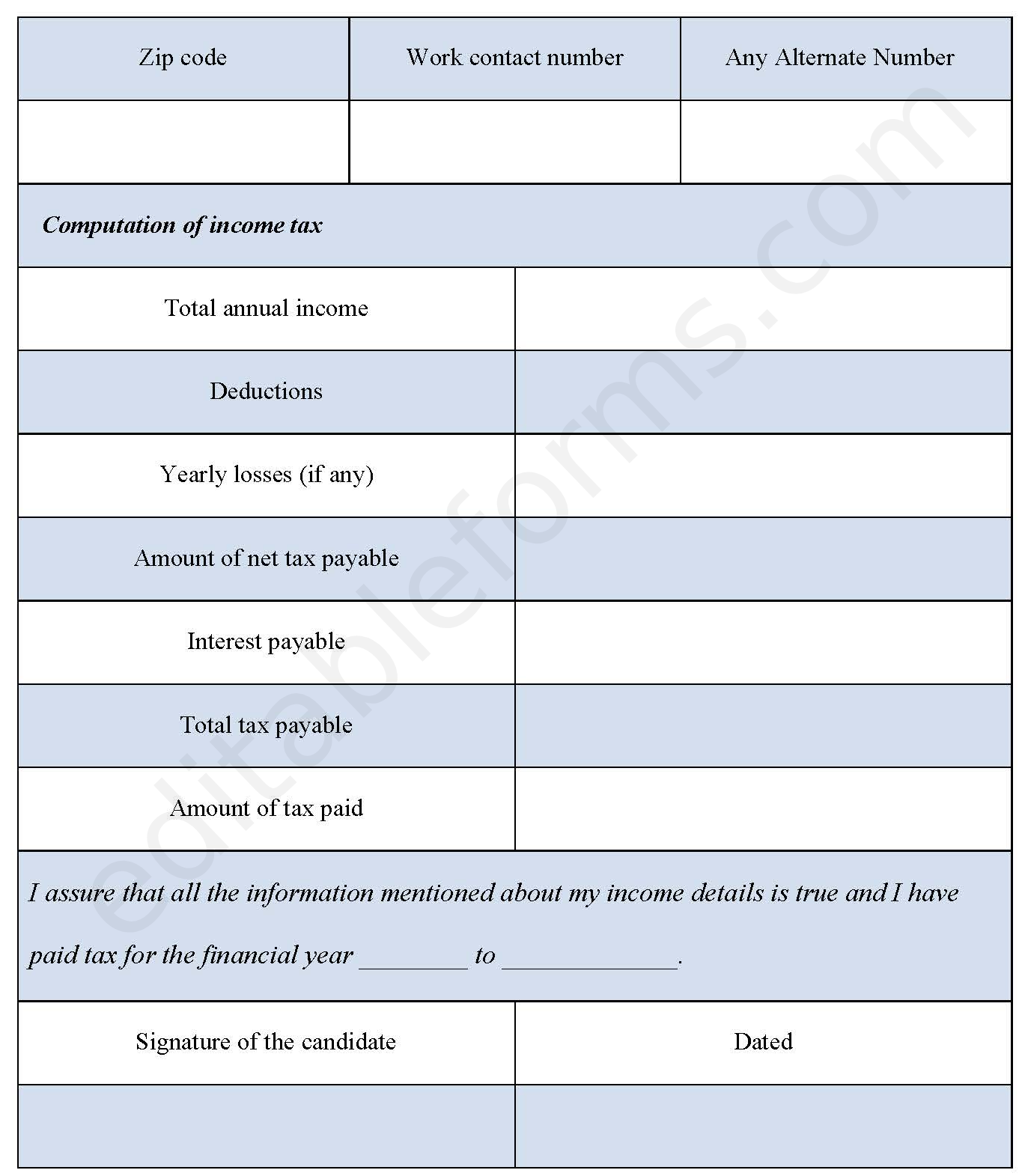

An income tax verification form verifies whether a person has paid tax on his income or not. This form is also used to check whether the individual has furnished all his income details correctly.

You can Download the Income Tax Verification Template, customize it according to your needs, and Print it. Income Tax Verification Template is either in MS Word or Editable PDF.

Download the Income Tax Verification Form Template for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Features:

Verification of ITR Filing:

The ITR-V serves as proof that you have electronically filed your income tax return. It includes details like your assessment year, acknowledgement number, and basic taxpayer information.

Multiple Verification Methods:

You have two options to verify your ITR-V:

Digital Signature:

If you filed your ITR with a digital signature, the ITR-V itself is considered verified.

Physical Verification:

If you didn’t use a digital signature, you need to print the ITR-V, sign it, and mail it to the Income Tax Department’s Centralized Processing Center (CPC). They will then process the verification.

Benefits:

Completes ITR Filing Process:

Verification using the ITR-V is a mandatory step to complete the electronic filing of your income tax return. Without verification, your ITR filing is considered incomplete.

Provides Record of Filing:

The ITR-V serves as a record for your personal files, demonstrating that you filed your return on time.

Prevents Processing Delays:

Verifying your ITR-V ensures timely processing of your tax return by the Income Tax Department, potentially avoiding delays or penalties.