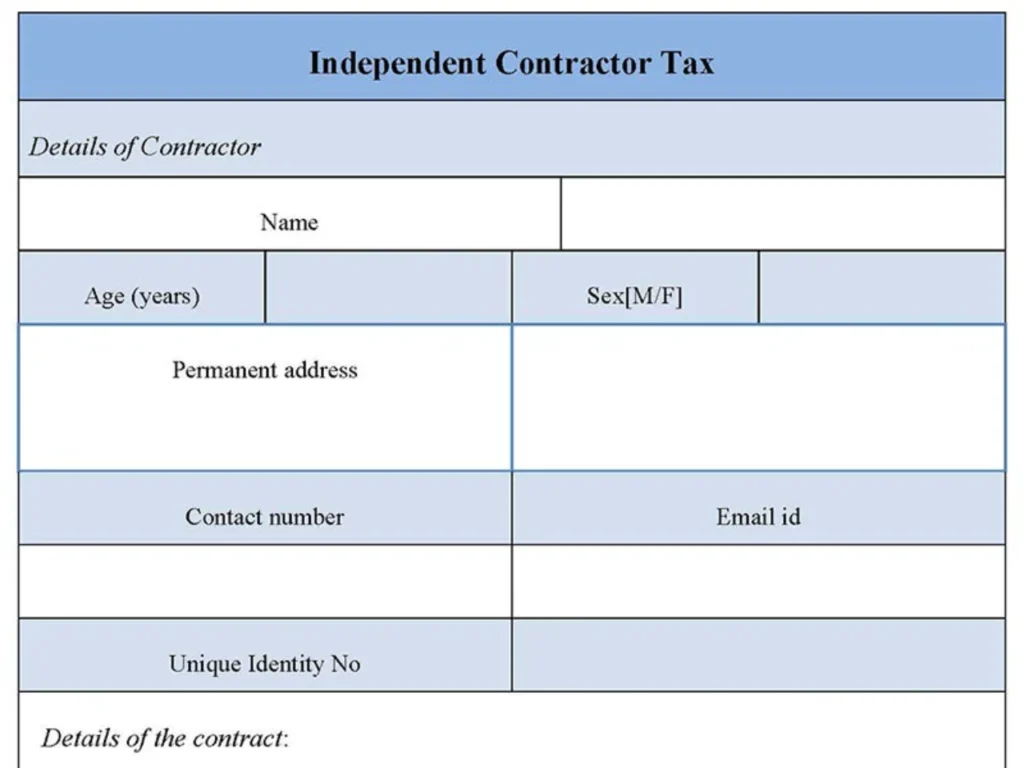

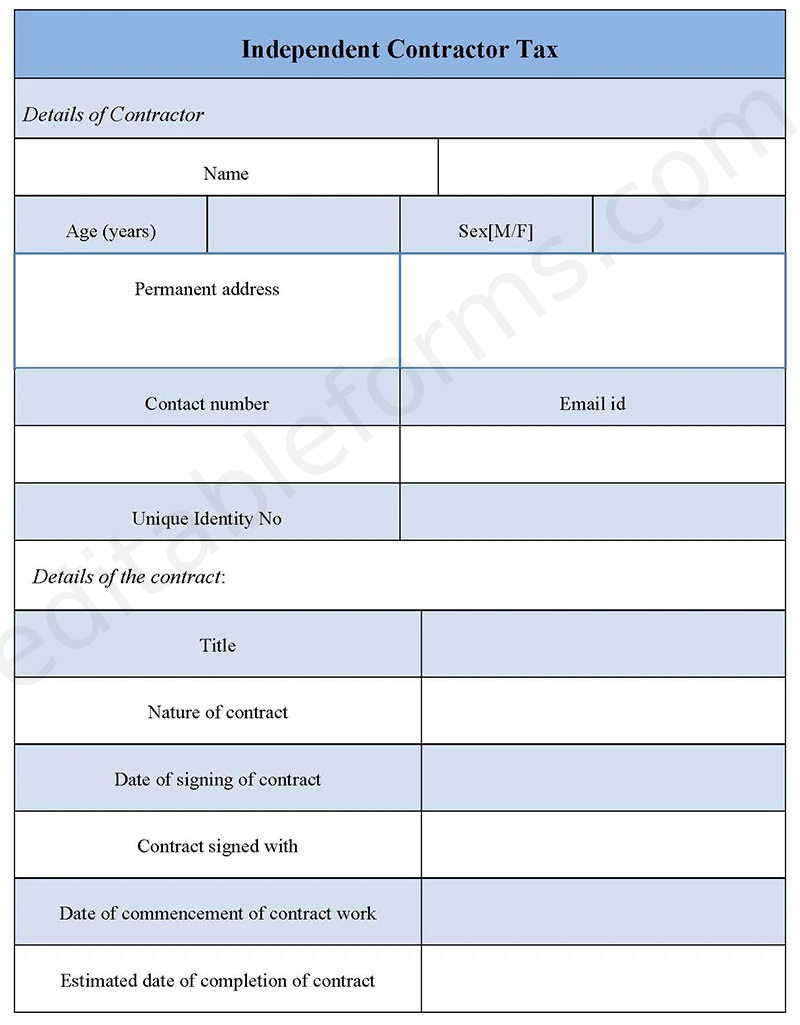

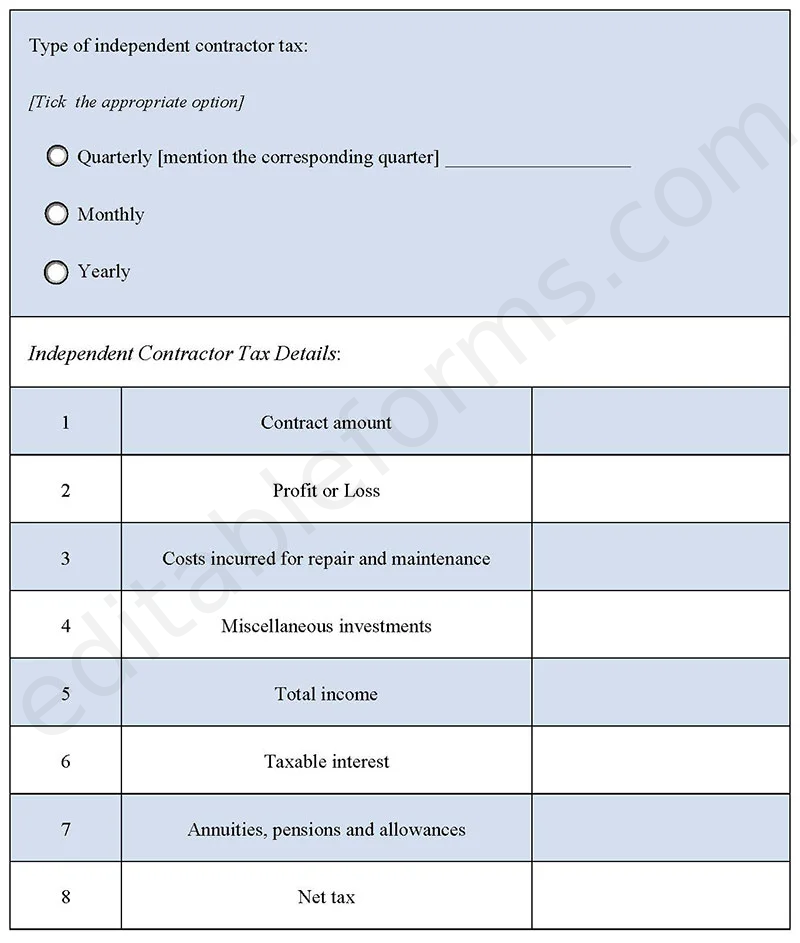

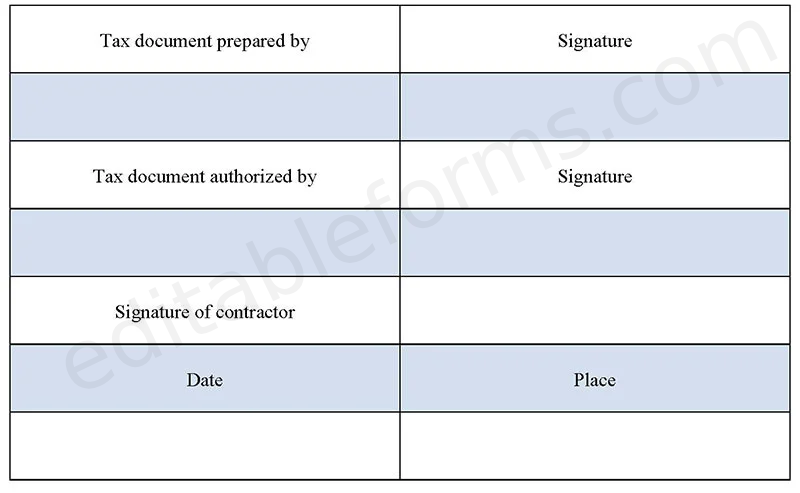

An independent contractor tax form is prepared to account for the special cases of tax payment by contractors who work independently, for a person, firm, or organization. The nature of the job of an independent contractor will vary with variations in the nature of the corresponding contract, and tax returns will be calculated accordingly. The financial structure of the contract will determine the features of the contractor tax and parameters will be set accordingly. Hence, the tax form should clearly depict details of the independent contractor and the type of contract presently signed or generally signed by the person, and should include all particulars and financial details required for the respective tax document.

You can Download the independent contractor tax form t; customize it according to your needs and Print. India Will Form is either in MS Word and Editable PDF.

Download Independent Contractor Tax Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Personal and Business Information:

Collects essential details such as contractor’s name, address, tax ID, and business details for accurate reporting.

Income and Expense Reporting:

Includes fields for detailing income earned, along with deductible expenses to optimize tax reporting.

Estimated Tax Payments Section:

Allows contractors to report any estimated tax payments made throughout the year, ensuring accurate annual tax calculations.

Deductions and Credits:

Provides options to declare eligible deductions and credits, such as home office expenses and business-related costs.

Electronic Submission Options:

Supports digital submission for quick processing, reducing paperwork and enhancing convenience.

Benefits:

Accurate Tax Calculation:

Ensures that contractors can report income and expenses comprehensively, helping to avoid errors and overpayments.

Optimized Tax Savings:

Allows independent contractors to claim deductions and credits specific to self-employment, minimizing taxable income.

Simplified Filing Process:

Streamlines tax filing with organized fields, making it easier for contractors to complete forms accurately.

Convenient Digital Access:

Enables contractors to submit their tax forms online, providing a fast and secure filing method.

Enhanced Financial Tracking:

Organizes all relevant income and expenses, supporting better financial management and planning for independent contractors.