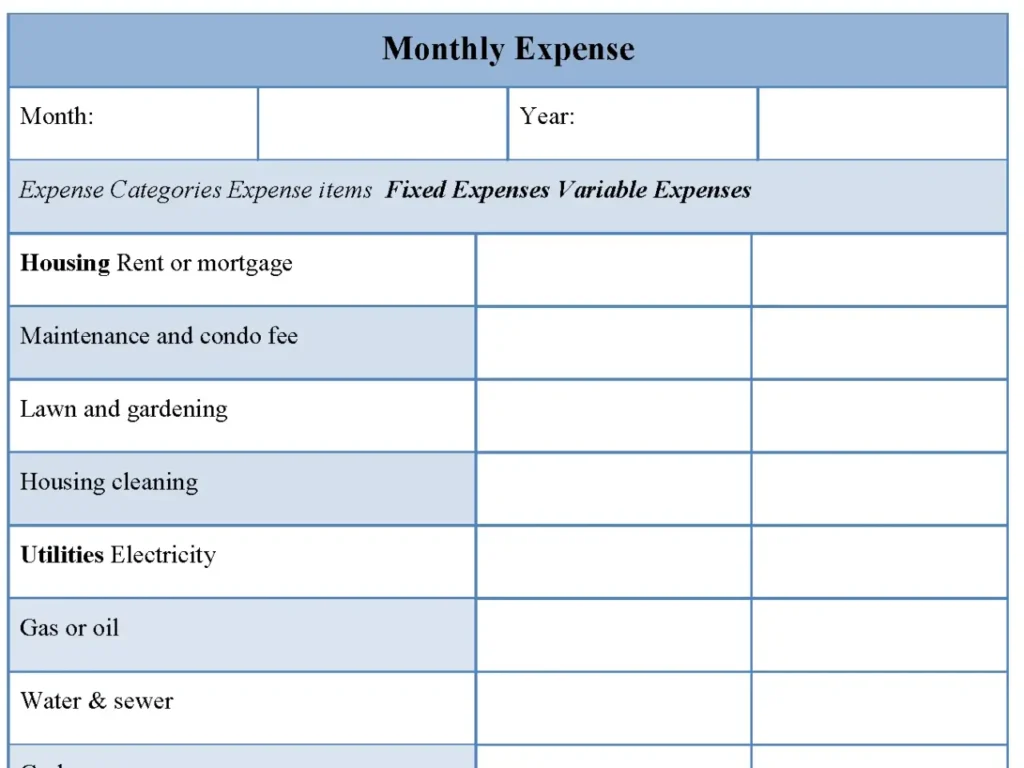

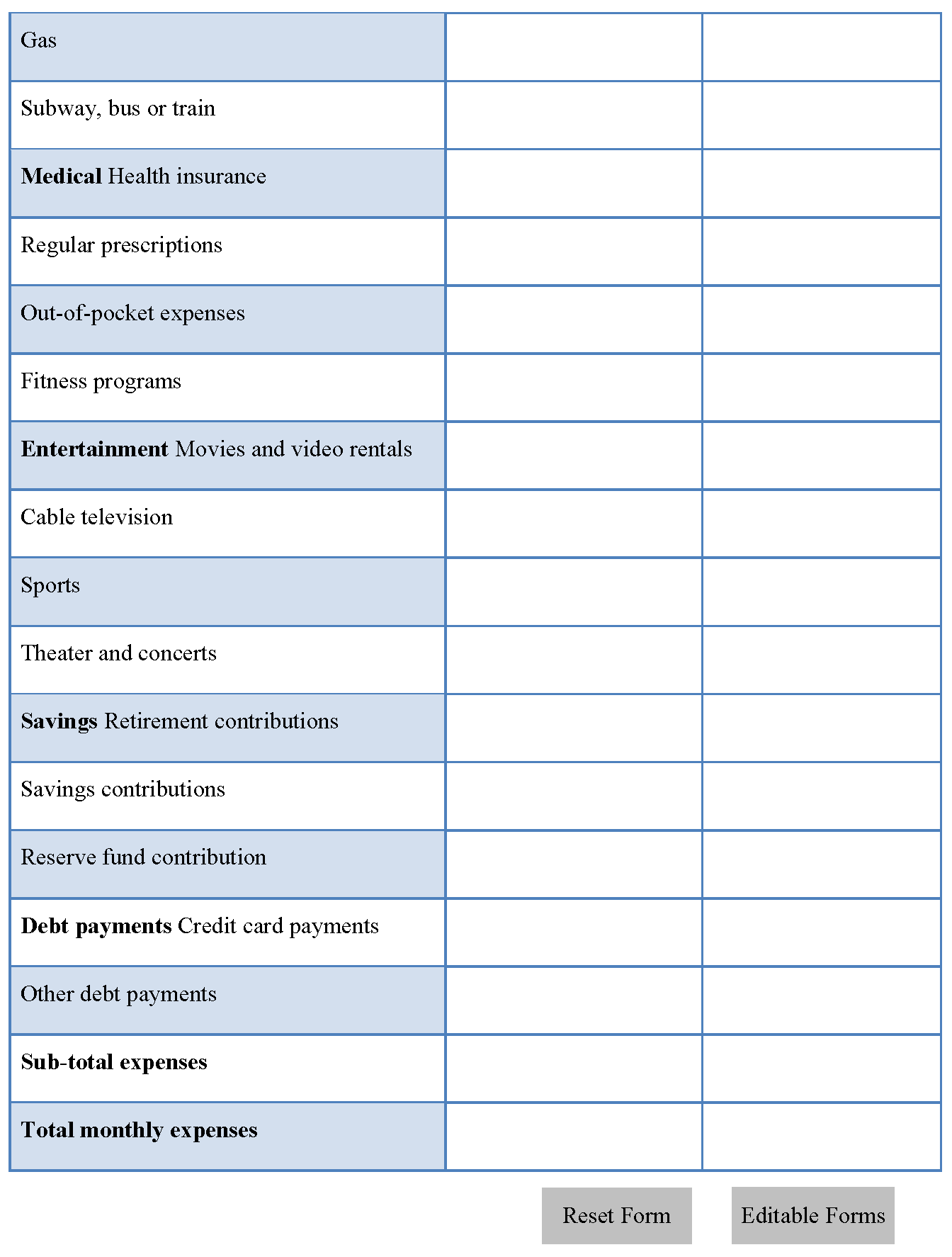

A monthly expense form divides up expenses into either fixed or flexible. Fixed expenses are expenses that must be paid and form part of basic expenses. The variable expenses can be items that are not incurred on monthly basis or are only incurred when there is money left from the fixed expenses. A monthly expense form looks thus:

You can Download the Monthly Expense Form post; customize it according to your needs and Print. Monthly Expense Form is either in MS Word and Editable PDF.

Download Monthly Expense Form for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Features :

Structured Categories:

Provides predefined categories for tracking various types of expenses, such as housing, transportation, food, utilities, and also entertainment.

Date Fields:

Includes sections for entering the date of each expense, helping users maintain accurate records over time.

Amount Fields:

Offers designated fields for inputting the amount spent in each category, allowing for easy calculations and also tracking.

Total Calculation Section:

Automatically sums total expenses at the end of the form, providing users with a quick overview of their monthly spending.

Recurring Expenses Feature:

May include options for noting recurring monthly expenses, helping users budget also more effectively.

User-Friendly Layout:

Designed for ease of use, with clear headings and also intuitive design to simplify the expense tracking process.

Benefits:

Financial Awareness:

Encourages users to become more aware of their spending habits, helping them identify areas where they can cut costs.

Budgeting Tool:

Serves as an effective tool for creating and maintaining a monthly budget, promoting better financial management.

Accountability:

Helps users hold themselves accountable for their spending by providing a clear record of monthly expenses.

Data Organization:

Organizes financial data in a structured manner, making it easier to review spending patterns and also trends over time.

Planning for Future Expenses:

Assists users in planning for future expenses by analyzing past spending habits and also predicting future needs.

Financial Goal Setting:

Aids in setting and also tracking financial goals by providing a clear overview of income versus expenses.

Tax Preparation:

Simplifies the process of preparing for tax season by providing organized documentation of expenses, which may be necessary for deductions.