A non-foreign person affidavit form is a document which is generally used in the sale of real estate. In the United States, if one buys land or real estate from a foreigner [someone not granted as an American citizenship] then the buyer has to withhold 10% of the sales price to account for the taxes in such a sale process. This kind of a form can be essentially used to provide an exemption, claiming that the seller of land is not a foreigner but a citizen of the United States. They attest to the claims of the citizenship that an individual makes, and hence, they also serve as a kind of identity proof.

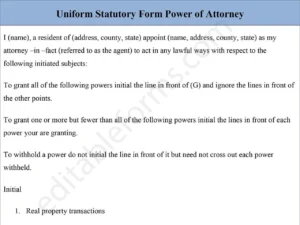

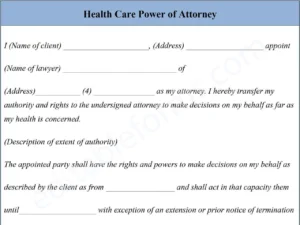

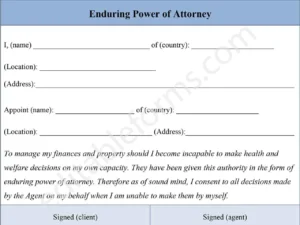

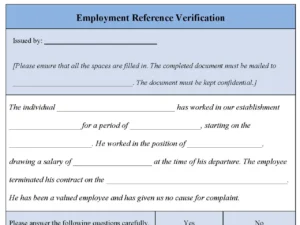

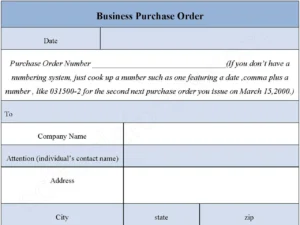

You can Download the Non Foreign Person Affidavit Form Template, customize it according to your needs, and Print it. Non Foreign Person Affidavit Form Template is either in MS Word or Editable PDF.

Download the Non Foreign Person Affidavit Form Template for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Certification of Non-Foreign Status:

The form provides a certification that the individual or entity is not a foreign person, as defined by FATCA and other regulations.

Identification Information:

The form typically includes fields for providing identification information, such as name, address, and taxpayer identification number (TIN).

Certification of Compliance:

The form includes a certification that the individual or entity is in compliance with all applicable laws and regulations, including FATCA.

Signature and Date:

The form requires a signature and also date, providing a record of the certification.

Customizable:

The form can be customized to fit the specific needs of the user, including adding or removing fields or sections as required.

Benefits:

Compliance with FATCA and Other Regulations:

The Non-Foreign Person Affidavit Form helps individuals and entities comply with FATCA and other regulations, reducing the risk of non-compliance and also associated penalties.

Simplified Due Diligence:

The form simplifies the due diligence process for financial institutions and other organizations, providing a standardized and efficient way to verify the non-foreign status of individuals and also entities.

Reduced Risk of Withholding:

By certifying non-foreign status, individuals and entities can reduce the risk of withholding on payments and also transactions.

Increased Efficiency:

The form streamlines the process of verifying non-foreign status, saving time and reducing administrative burdens.

Improved Accuracy:

The form helps ensure accurate certification of non-foreign status, reducing errors and also potential penalties.

Enhanced Transparency:

The form provides a clear and transparent record of certification, making it easier to demonstrate compliance with regulations.

Reduced Audit Risk:

By accurately certifying non-foreign status, individuals and entities can reduce the risk of audit and also potential penalties.

Improved Relationships with Financial Institutions:

The form helps individuals and entities establish and maintain relationships with financial institutions, by providing a standardized and also efficient way to verify non-foreign status.