A Notice of Dishonored Check Form is a fillable PDF template used to formally notify individuals or businesses of a bounced check due to insufficient funds. This document helps streamline communication and request repayment, maintaining legal compliance and also professionalism in handling financial disputes.

You can Download the Notice of Dishonored Check Form, customize it according to your needs, and Print it. Notice of Dishonored Check Form is either in MS Word or Editable PDF.

Download the Notice of Dishonored Check Form for only $6.54.

Buy Now: 6.54 USDAbsolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

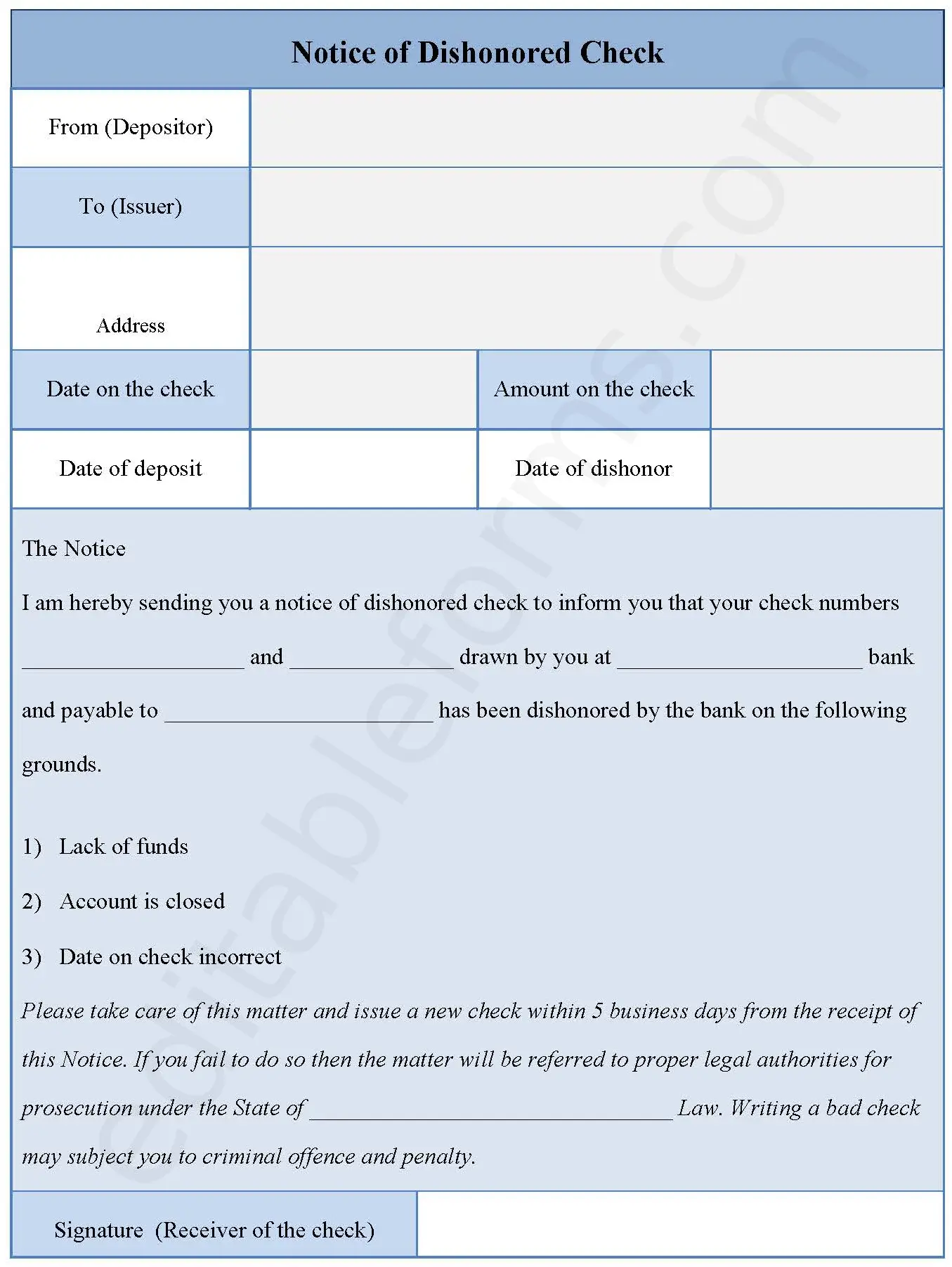

Header Information:

Includes sections for the depositor’s name, the issuer’s name, and the address where the notice sent.

Check Details:

Specifies the check numbers, the bank where the check was drawn, the amount of the check, the date the check was issued, the date it was deposited, and also the date it was dishonored.

Reason for Dishonor:

Outlines the reason for the check being dishonored, which can include lack of funds, the account closed, or an incorrect date on the check.

Notice of Dishonor:

Clearly states that the document is a notice of dishonored check and also informs the issuer of the dishonor.

Request for Repayment:

Requests that the issuer issue a new check within 5 business days from the receipt of the notice.

Legal Consequences:

Warns the issuer that failure to comply with the request may result in legal action, including criminal charges and also penalties.

Signature:

A section for the receiver of the check to sign.

Benefits

Clarity:

The template ensures clear communication regarding the dishonored check and also the required action.

Efficiency:

It saves time by providing a pre-formatted document that easily filled out.

Standardization:

Using a template helps ensure consistency across different notices of dishonored checks.

Legal Compliance:

A well-drafted notice of dishonored check can help ensure compliance with relevant legal requirements.

Record Keeping:

The signed notice serves as a record of the dishonored check and also the sender’s request for repayment.