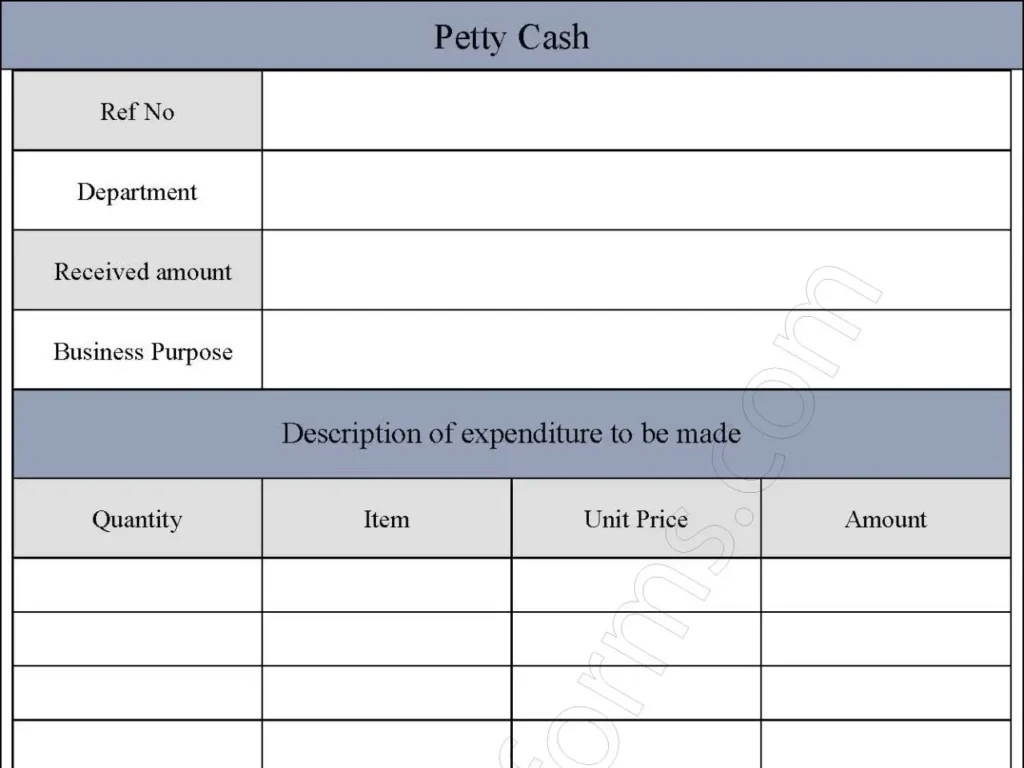

Petty cash is the small amount of cash and coins that an organization uses for minor purchases and providing change to customers. A petty cash form is the form that the handler of petty cash uses to keep track of petty cash disbursements and reimbursements. This form is retained by the accountant and he uses it when calculating expenses. It is easier to keep a petty cash form if the petty cash vouchers are up to date and accurate. Below is a sample petty cash form.

You can Download the Petty Cash Form, customize it according to your needs and Print. Petty Cash Form Template is either in MS Word, and Editable PDF.

Download the Petty Cash Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Date of Transaction:

Records the exact date of each petty cash expenditure for chronological tracking.

Description of Expense:

Provides a space to note the purpose of each transaction (e.g., office supplies, travel expenses).

Amount Spent:

Clearly shows the exact cash amount withdrawn for each transaction.

Account or Expense Category:

Helps categorize expenses by type (e.g., supplies, meals, travel) for easier tracking and also reporting.

Remaining Balance:

Updates the remaining balance after each transaction, showing how much petty cash is left.

Authorized Signature:

Requires a signature from the individual withdrawing the cash, ensuring accountability.

Benefits:

Enhanced Expense Tracking:

Provides a structured record of small cash expenses, helping keep track of minor spending and also reducing discrepancies.

Improved Financial Control:

Helps maintain tighter control over petty cash by documenting each expense and also ensuring funds are used appropriately.

Streamlined Reconciliation:

Facilitates easy reconciliation by clearly showing expenses and also remaining balances, reducing time spent on accounting.

Increased Accountability:

Requires signatures and also documentation for each transaction, holding employees accountable for their petty cash use.

Efficient Financial Reporting:

Allows for easier integration of petty cash expenses into broader financial statements or monthly reports.

Simplified Budgeting:

By categorizing petty cash expenses, businesses can better understand where funds are used and also adjust budgets as needed.

Fraud Prevention:

Reduces the risk of misuse or fraud by ensuring all petty cash transactions are recorded and also verified with receipts.

Convenient for Small Purchases:

Provides a quick, accessible way for employees to cover small business expenses without needing to go through formal purchasing channels.