Petty cash allows you to make small purchases or reimbursements, in cash, for items such as stamps, office supplies, parking, etc. To disburse petty cash funds, an organization will need to buy or develop petty cash vouchers which are used for documenting each transaction. This form is used by an accountant or a petty cash handler to disburse or accept refunds from the person using the petty cash. Below is a sample petty cash voucher.

You can Download the Petty Cash Voucher Form Template, customize it according to your needs and Print. Petty Cash Voucher Form Template is either in MS Word and Editable PDF.

Download the Petty Cash Voucher Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

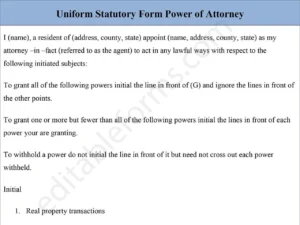

Features:

Date Field:

Captures the exact date the petty cash transaction occurred for chronological tracking.

Voucher Number:

Assigns a unique identifier for each voucher, making it easy to track and also reference specific transactions.

Amount Section:

Clearly specifies the amount of cash disbursed, helping to avoid errors.

Purpose of Expense:

Provides a space to describe the reason for the expenditure, ensuring transparency about how the funds are used.

Requester’s Name:

Records the name of the person requesting the petty cash, and also linking transactions to specific individuals.

Approval Signature:

Requires authorization from a supervisor or manager, adding an additional layer of oversight.

Remaining Balance Section:

Optionally tracks the remaining balance in the petty cash fund after the transaction.

Benefits:

Clear Documentation of Expenses:

Ensures all petty cash transactions are documented, providing a reliable record of small expenditures.

Enhanced Accountability:

Links each cash disbursement to an individual and also requires approval, promoting responsible use of petty cash.

Improved Budget Management:

Offers insight into recurring small expenses, enabling better tracking of miscellaneous costs for budgeting purposes.

Efficient Reconciliation:

Facilitates easy reconciliation of petty cash by matching voucher amounts to actual disbursements, minimizing discrepancies.

Fraud Prevention:

Reduces the risk of misuse or unapproved spending by requiring signatures and also receipts for each transaction.

Streamlined Expense Reporting:

Simplifies the process of reporting and also categorizing minor expenses, making it easier to compile monthly or quarterly reports.

Time Savings for Minor Purchases:

Allows employees to access funds for small, necessary purchases quickly without waiting for formal approvals.

Transparency and Audit Compliance:

Provides a structured record for audits, ensuring that petty cash transactions meet internal and also external compliance standards.