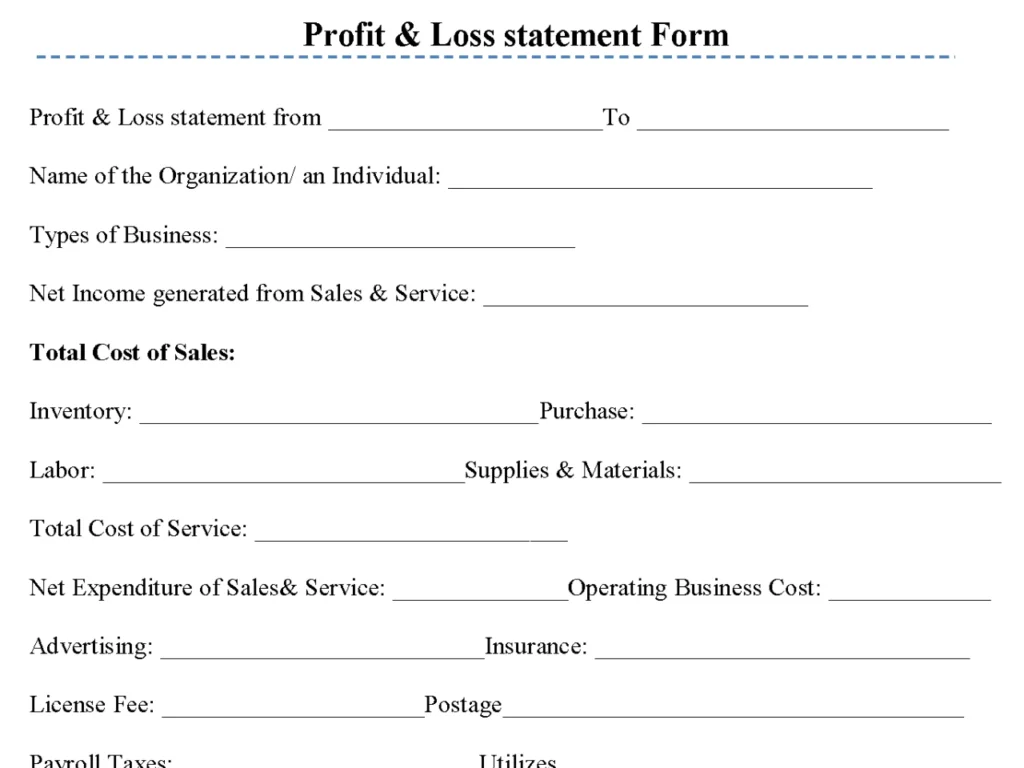

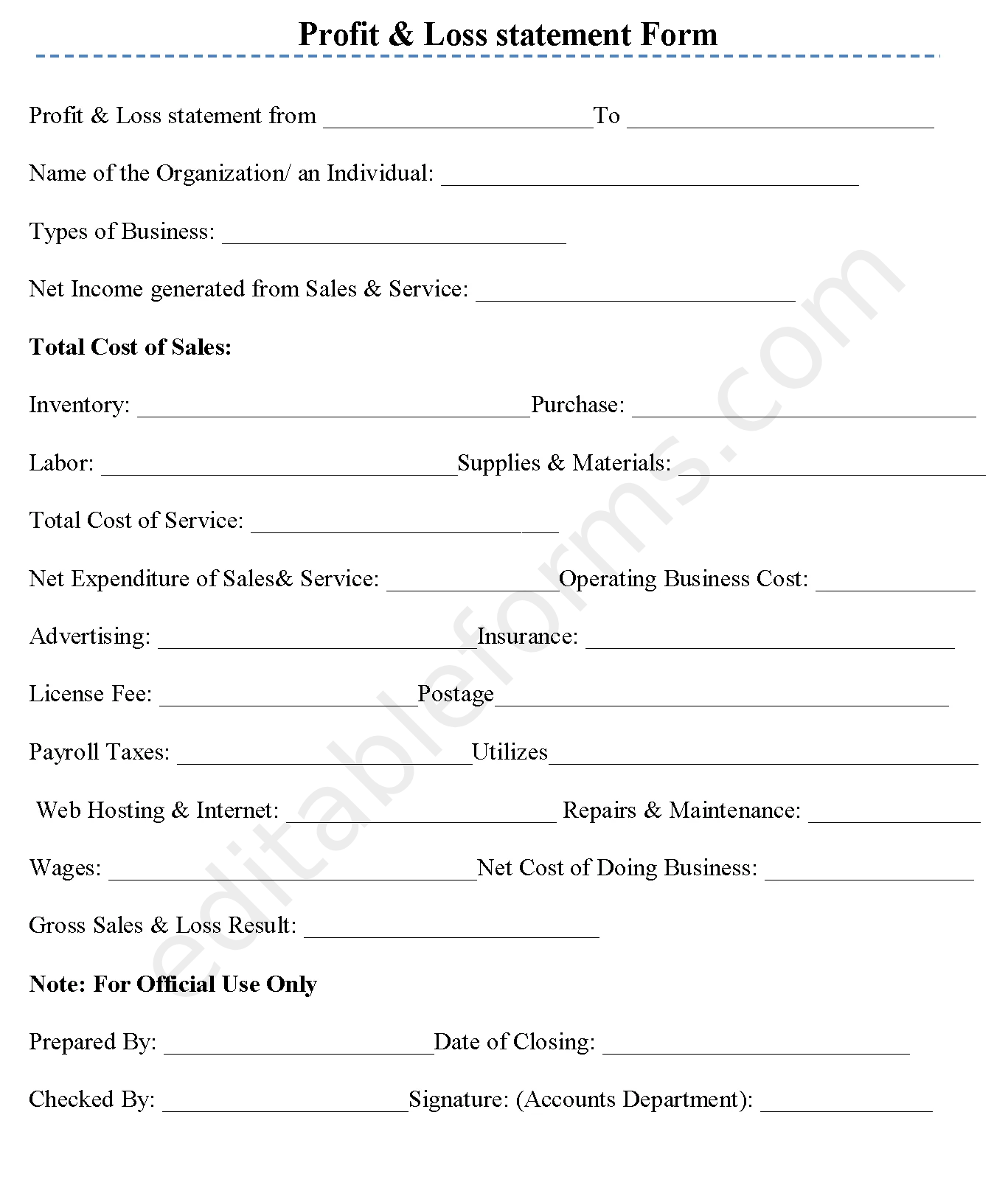

The Profit & Loss Statement Form provides a structured way to record income and expenses, calculate profits, and analyze financial performance over time. It simplifies tax preparation, supports budget management, and also enhances financial clarity, helping businesses make informed decisions to maximize profitability and also track growth effectively.

You can Download the Profit & Loss statement Form post; customize it according to your needs and Print. Profit & Loss statement Form is either in MS Word and Editable PDF.

Download Editable Profit & Loss statement Form for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Income and Revenue Tracking:

Dedicated sections to record all sources of income, helping businesses clearly see their total revenue for the period.

Expense Breakdown:

Organized fields to categorize expenses, such as operational costs, salaries, and also marketing, for a detailed view of outflows.

Gross and Net Profit Calculation:

Automated fields to calculate gross and also net profit, simplifying the assessment of financial performance.

Comparative Analysis:

Allows for monthly or yearly comparisons, enabling businesses to track trends and also make informed financial decisions.

Tax Deduction Insights:

Provides a summary of deductible expenses, aiding in accurate tax reporting and also potential savings.

Benefits:

Enhanced Financial Clarity:

Offers a clear view of profitability, allowing business owners to understand financial health at a glance.

Improved Decision-Making:

With detailed income and expense data, businesses can make better strategic decisions to maximize profits.

Simplified Tax Preparation:

Organized expense tracking aids in tax filing, helping ensure accurate and efficient reporting.

Supports Growth Planning:

Insight into profit trends helps businesses plan for expansion, identify cost-saving opportunities, and also set realistic goals.

Budget Management:

Highlights major expenses and revenue sources, enabling more effective budgeting and also financial management.