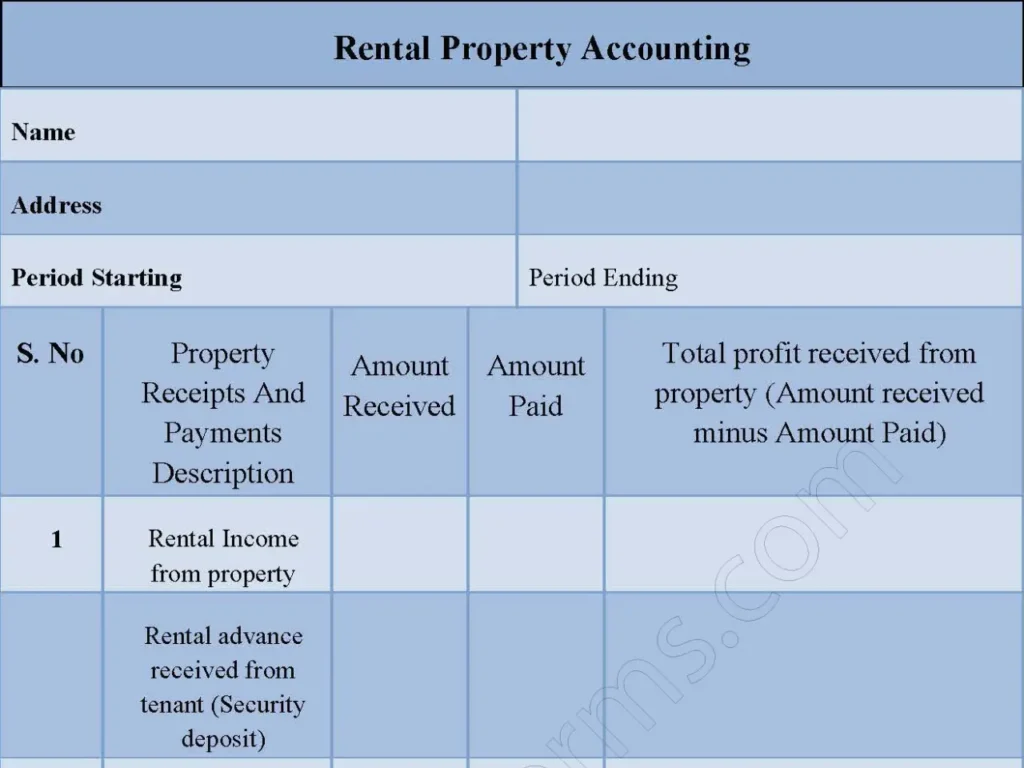

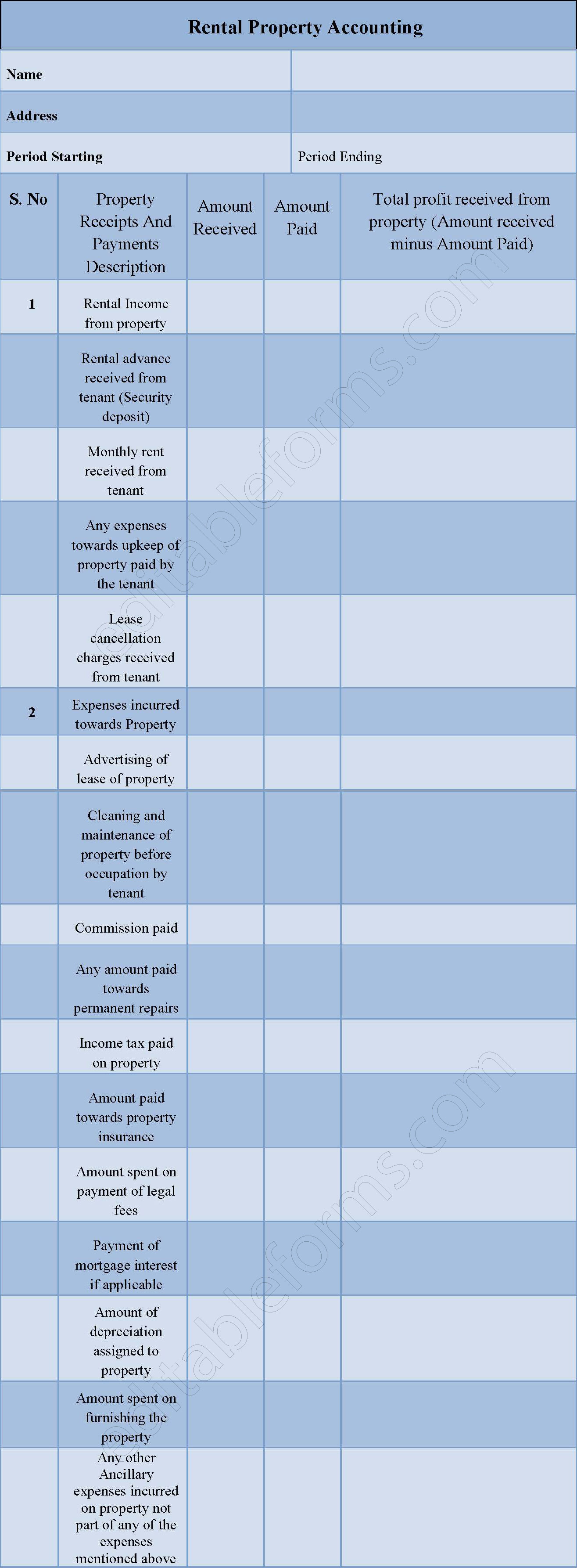

A rental property accounting form is used to keep track of all the incomes and expenses that arise on account of rented property. This form helps the owner of the property to arrive at the actual profit earned from the property owned. This form helps in tracking ones property in terms of the income it generates along with the assignment of depreciation and also any of the upkeep expenses incurred against it. This form is useful for the owner of the property to assess rent apart from collection, accounting and arrears accumulation of the rent.

You can Download the Rental Property Accounting Form, customize it according to your needs and Print. Rental Property Accounting Form` Template is either in MS Word and Editable PDF.

Download the Rental Property Accounting Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Property Information:

Sections to record the name and also address of the rental property.

Accounting Period:

Specifies the period covered by the accounting report.

Income and Expenses:

Categorizes income and expenses related to the rental property, including rental income, expenses incurred for the property, and taxes paid.

Total Profit:

Calculates the total profit received from the rental property, taking into account income and also expenses.

Benefits:

Standardization:

The template provides a structured format for recording rental property accounting information, ensuring consistency across records and also making it easier to analyze and manage finances.

Efficiency:

Using a pre-designed template saves time compared to creating an accounting form from scratch.

Clarity:

Ensures that all necessary information is included and presented in a clear and also organized manner, making it easier to understand and analyze rental property finances.

Accuracy:

The template helps minimize errors by providing a clear structure for recording financial transactions.

Record Keeping:

The completed rent accounting template serves as a valuable record of the rental property’s financial transactions, which can be important for tax purposes, financial reporting, and also decision-making.

Financial Analysis:

It is used to analyze the financial performance of the rental property, identify trends, and also make informed decisions about rental income and expenses.