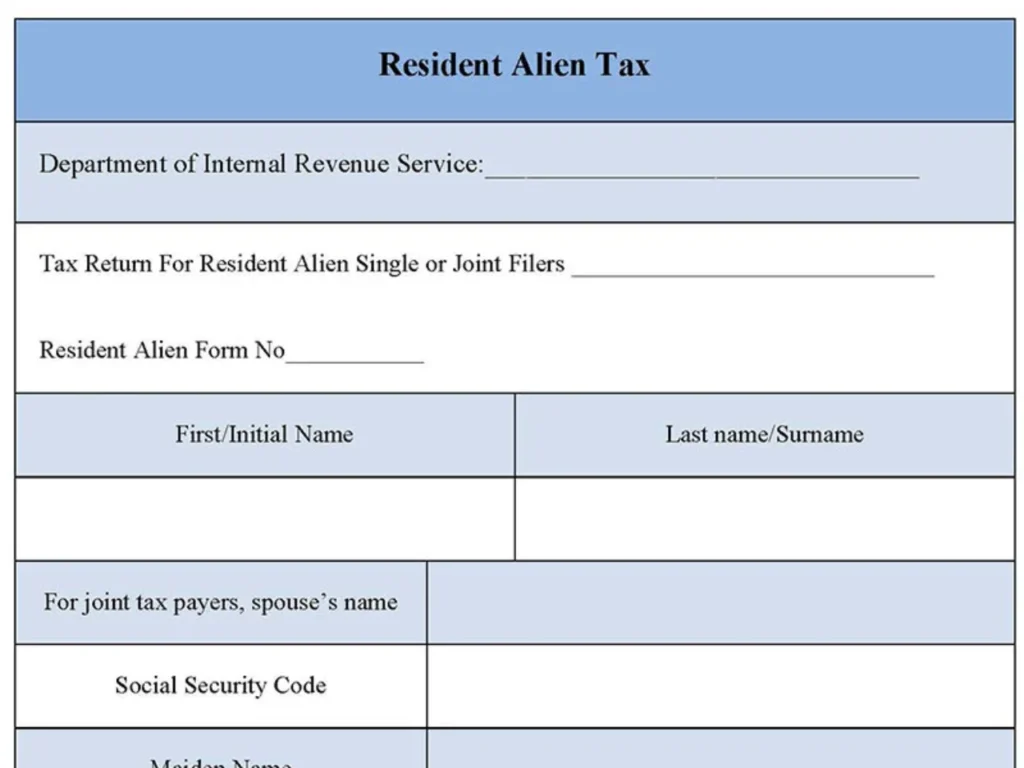

An immigrant who has started residing permanently on a country without acquiring its citizenship has to pay a certain amount of tariff as resident alien tax to the government, in order to avail some rights as the natives. Resident alien(s) have got both advantages and disadvantages. They can avail the foreign tax credit(s) just like a citizen whereas they also have to pay all the taxes that an individual has to be pay for being a citizen of the nation. Therefore, resident alien tax forms are varied in nature according to the purpose. However, most of them follow a general standard which can be customized on requirement.

You can Download the Resident Alien Tax Form post; customize it according to your needs and Print. Resident Alien Tax Form is either in MS Word and Editable PDF.

Download Resident Alien Tax Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Detailed Personal and Immigration Information:

Collects necessary details about residency status, country of origin, and identification numbers.

Dual-Status Tax Filing:

Supports tax filing for individuals with dual-status residency, helping them meet both foreign and U.S. tax obligations.

Digital Submission Capability:

Offers an electronic submission option for efficient and also secure tax filing.

Benefits:

Ensures Compliance with U.S. Tax Laws:

Helps resident aliens fulfill U.S. tax obligations accurately, minimizing penalties.

Maximizes Tax Savings:

Enables individuals to claim deductions and credits, reducing overall tax liability.

Simplifies Complex Reporting:

Guides resident aliens through complex reporting requirements, including foreign income.

Convenient Filing Process:

Digital submission saves time and provides a secure alternative to paper filing.

Supports Financial Accuracy:

Ensures that all income, credits, and deductions are reported correctly, aiding in transparent tax reporting.