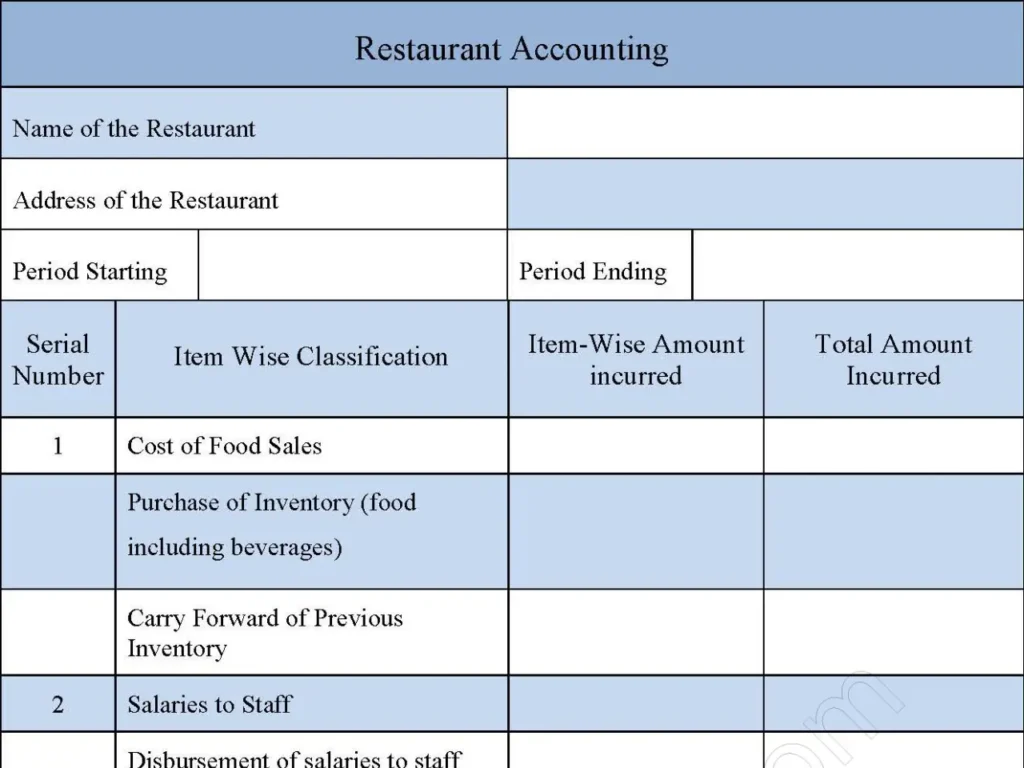

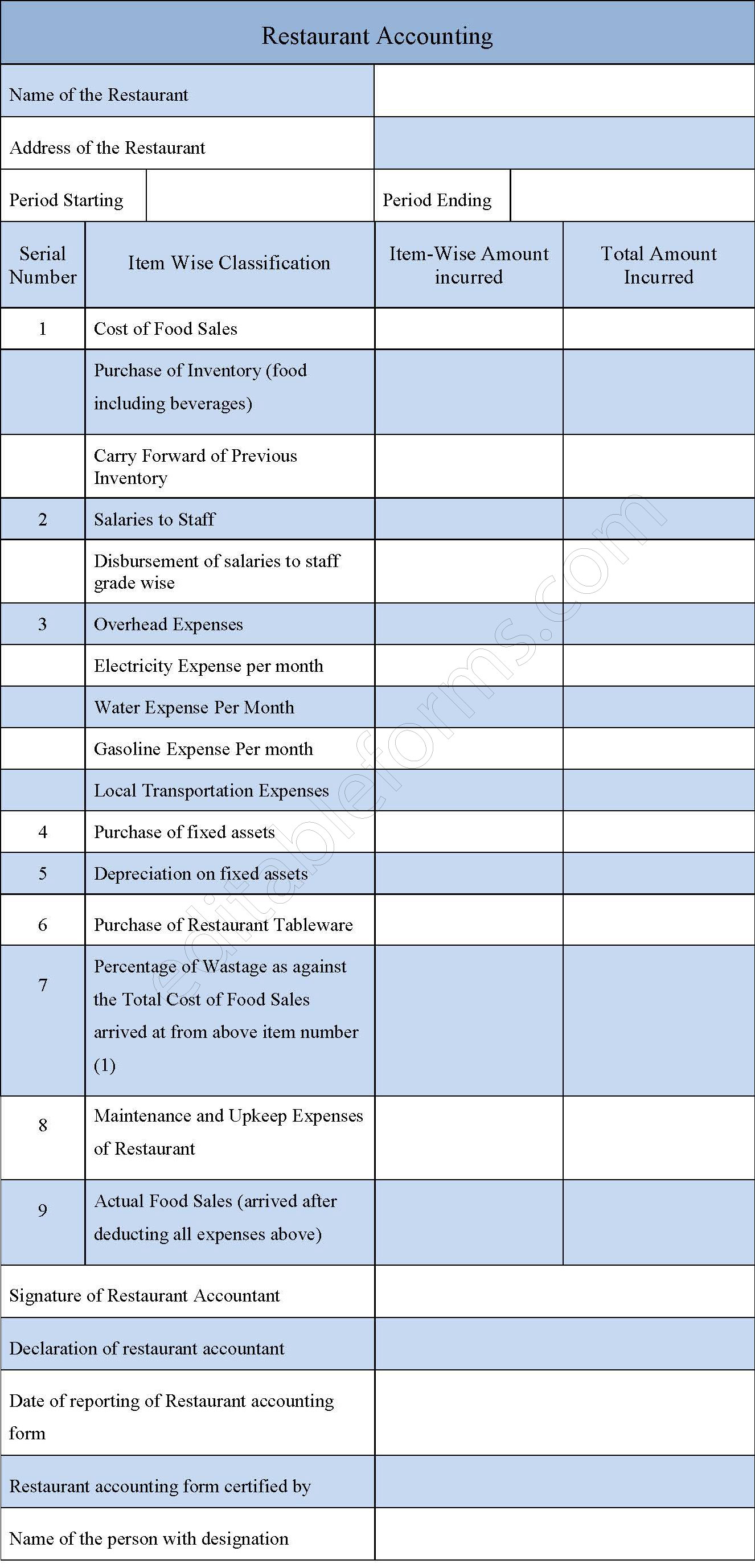

A restaurant accounting form is used to keep tab of all the income and expenditure incurred during a particular financial year in a restaurant. There are some restaurants that maintain a monthly accounting form so as to arrive at the cost-to-sales ration and analyze the percentage of wastage and other crucial parameters that are essential for profitability. The restaurant accounting form includes all items such as purchase of food items, salary to staff, maintenance costs etc.

You can Download the Restaurant Accounting Form, customize it according to your needs and Print. Restaurant Accounting Form Template is either in MS Word and Editable PDF.

Download the Restaurant Accounting Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Sales Tracking:

Captures daily sales by category (e.g., food, beverages, takeout), allowing detailed monitoring of revenue sources.

Inventory Management:

Includes sections for tracking ingredient purchases, usage, and wastage, aiding in efficient inventory control.

Cost of Goods Sold (COGS):

Calculates the cost of goods sold based on inventory and sales data, helping determine the true cost of food and also drink items.

Labor Cost Tracking:

Records staff wages and hours, including tips, for accurate labor cost management.

Profit and Loss Summary:

Summarizes revenue, COGS, expenses, and also net profit, giving a clear financial snapshot.

Benefits:

Improved Financial Visibility:

Provides a clear picture of income and also expenses, allowing restaurant owners to monitor financial health in real time.

Enhanced Cost Control:

Tracks food, labor, and also overhead costs, helping identify areas of overspending or inefficiency.

Optimized Inventory Management:

Supports better ordering and reduces waste by tracking ingredient usage and also costs, which can significantly impact profitability.

Accurate Pricing Decisions:

Helps calculate COGS and profit margins, informing menu pricing strategies that ensure profitability.

Better Cash Flow Management:

Provides daily and weekly breakdowns of revenue and also expenses, enabling proactive cash flow planning.

Labor Cost Optimization:

Allows for close monitoring of labor expenses to avoid overstaffing or understaffing, which helps manage one of the largest operational costs.

Quick Performance Insights:

Offers easy-to-read summaries of financial performance, allowing restaurant owners to make timely adjustments in operations.

Compliance and Reduced Tax Stress:

Ensures all revenue, tax, and also compliance data are well-documented, minimizing the risk of issues during audits or tax filings.