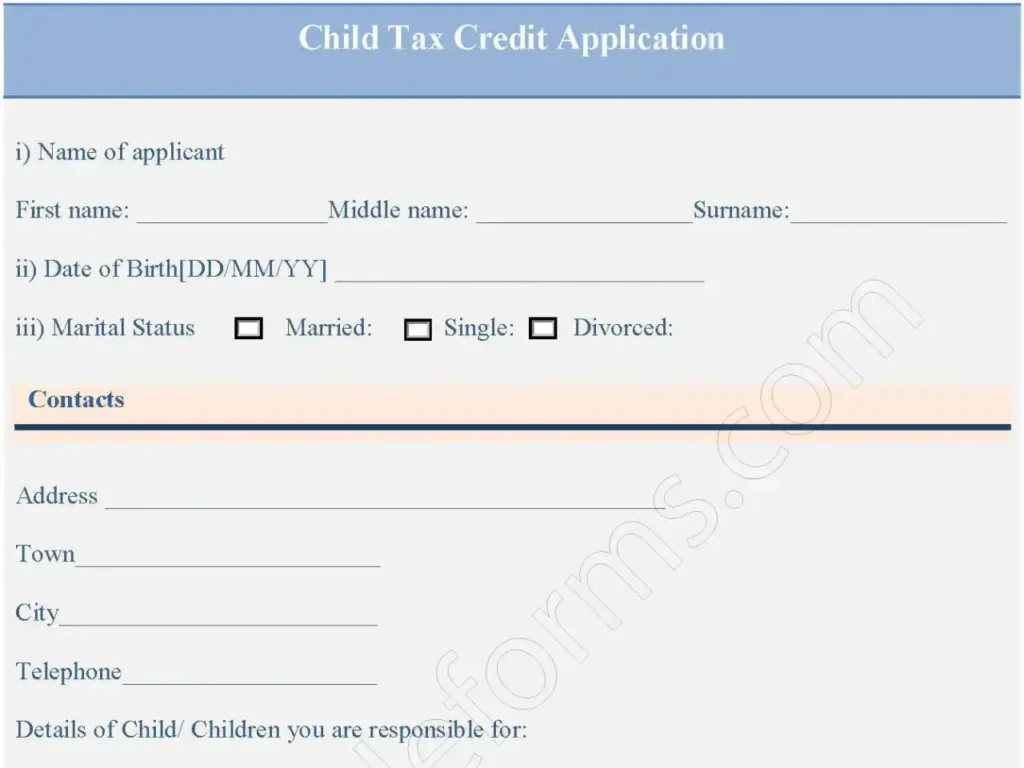

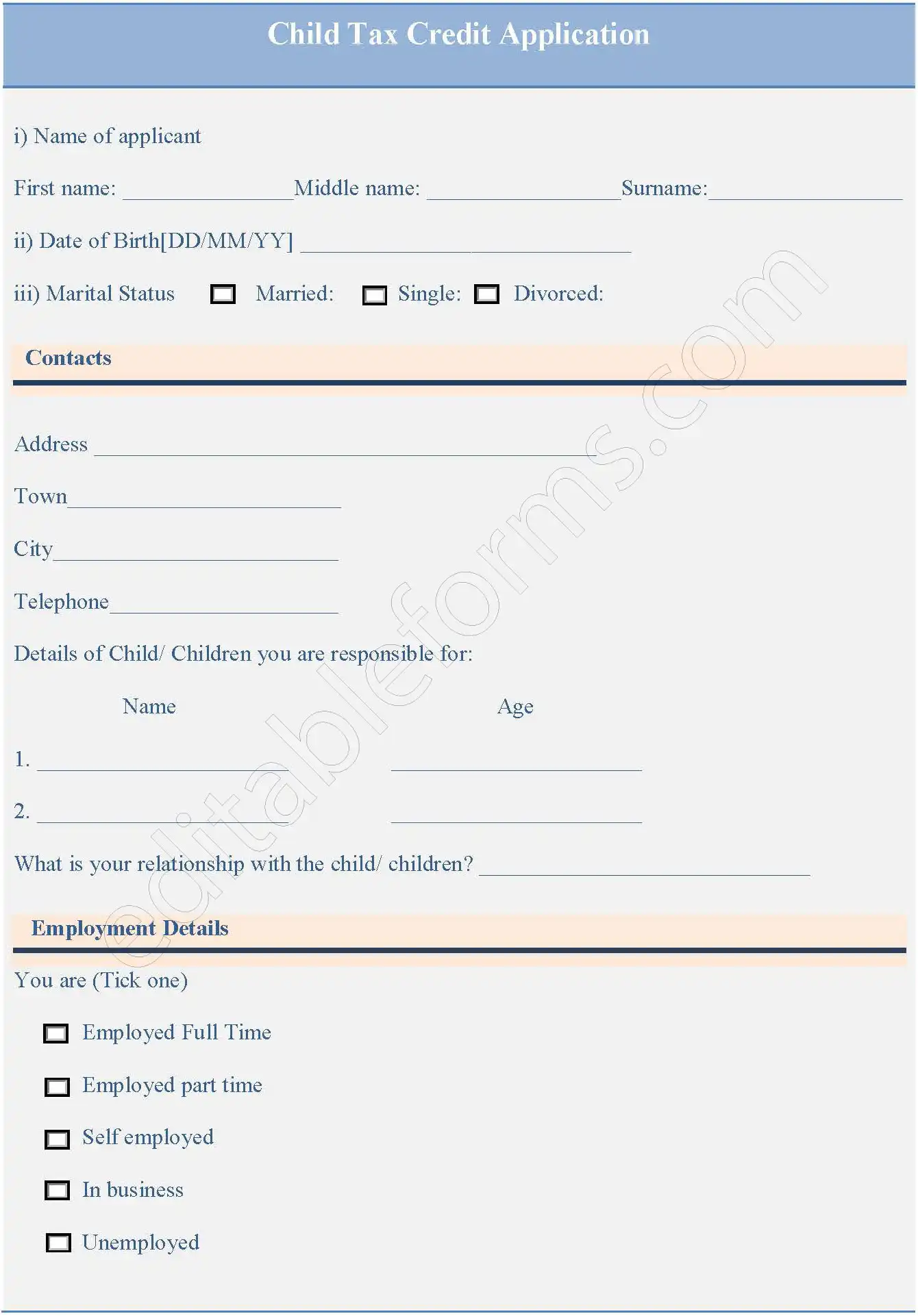

This is money given to anyone who is responsible for at least one child. Anyone over 16 years of age who is responsible for a child can claim for CTC so long as their income is of a particular limit. One can either claim CTC as an individual or a couple when married. A child is considered to be anyone below the age of 16. and here the sample child tax credit application form

You can Download the Sample Child Tax Credit Application Template, customize it according to your needs, and Print it. Sample Child Tax Credit Application Template is either in MS Word or Editable PDF.

Download the Sample Child Tax Credit Application Form Template for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Personal Information:

Name: Collects the applicant’s full name.

Date of Birth: Records the applicant’s date of birth.

Marital Status: Asks for the applicant’s marital status.

Contacts: Collects the applicant’s address, town, city, and also telephone number.

Dependent Children:

Details of Child/Children: Provides space to list the names and ages of the children for whom the applicant is claiming the credit.

Relationship: Asks for the applicant’s relationship to the children.

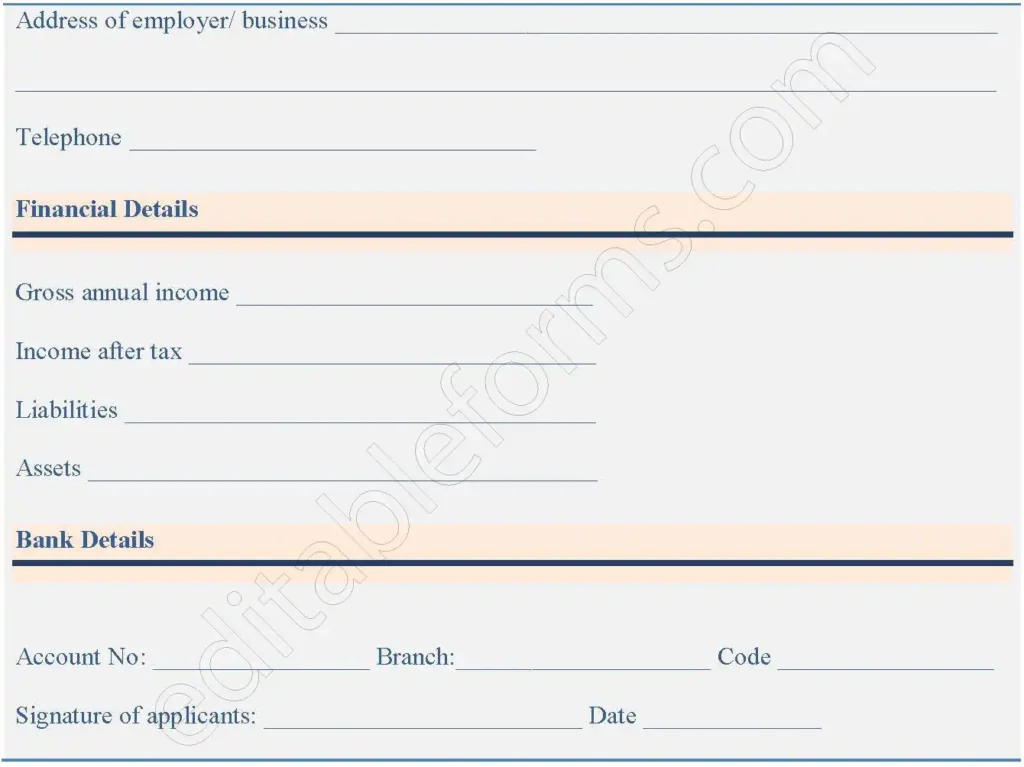

Employment Information:

Employment Status: Allows the applicant to indicate their current employment status (full-time, part-time, self-employed, in business, or unemployed).

Signature:

Signature: Requires the applicant’s signature to confirm the accuracy of the information provided.

Benefits

Standardization:

Ensures consistency in collecting information from all applicants.

Clarity:

Clearly outlines the required information, making it easy for applicants to complete the form.

Efficiency:

Streamlines the application process by providing a structured format.

Record Keeping:

Serves as a valuable record of applicant information, which can be important for processing claims and also tax purposes.

Accuracy:

Reduces the risk of errors and also omissions in the application.

Compliance:

Helps ensure that applications comply with tax regulations and also eligibility criteria.