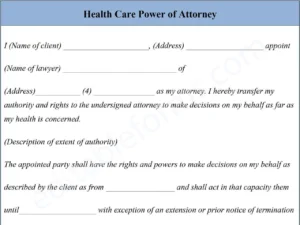

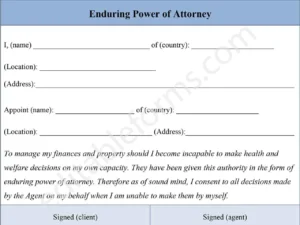

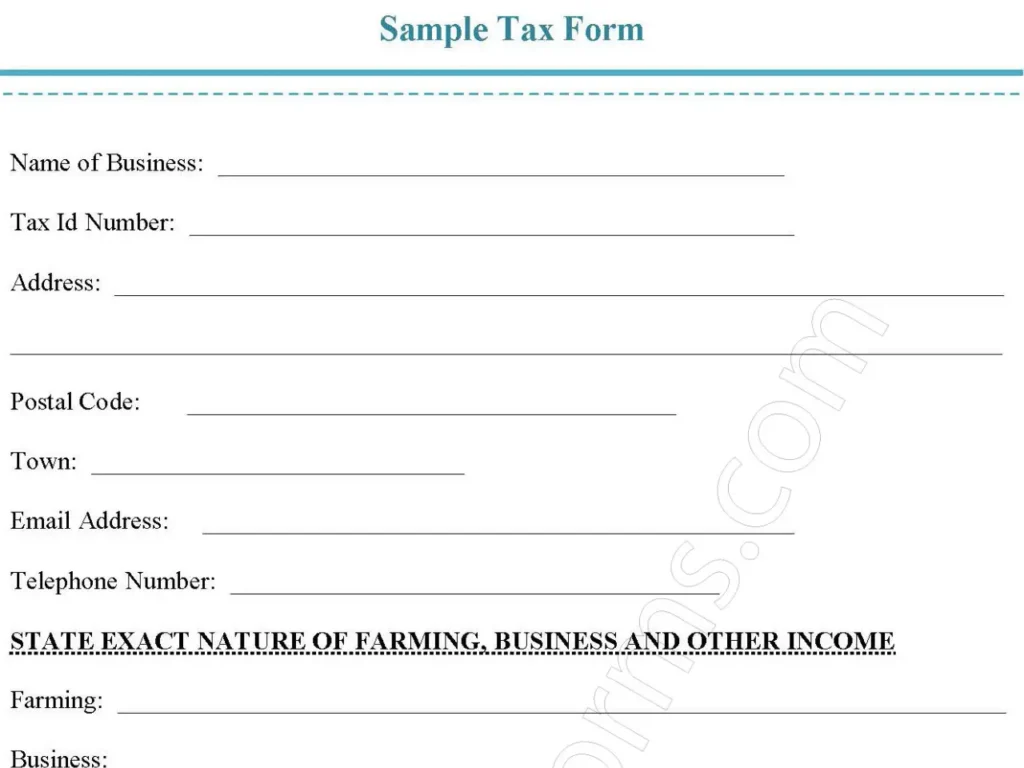

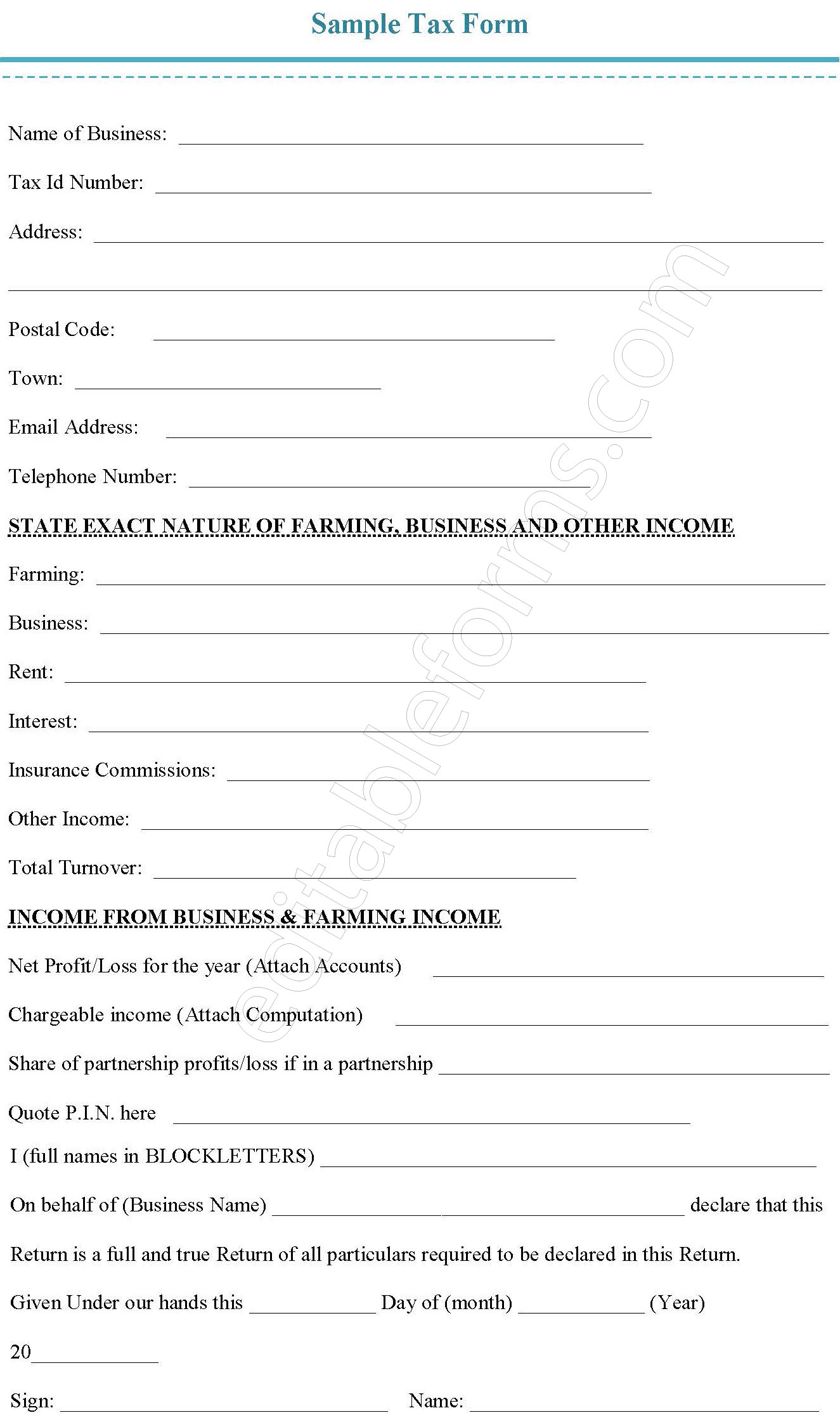

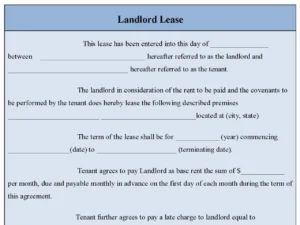

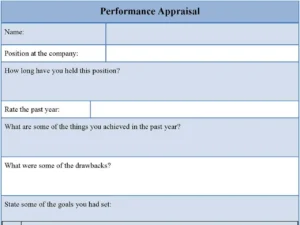

Tax forms are used to register businesses for taxes. It helps the proprietor register tax returns since it is illegal not to pay taxes. In different countries, the tax forms looks different but below is a sample of a tax form that includes the most basic information that is required. Below is a sample tax form.

You can Download the Sample Tax Form, customize it according to your needs and Print. Sample Tax Form Template is either in MS Word, and Editable PDF.

Download the Sample Tax Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Comprehensive Tax Information Sections:

Includes sections for personal information, income details, deductions, and also tax credits, ensuring a complete tax return.

Clear and Organized Layout:

Structured in an easy-to-understand format, guiding users through the process of completing each section accurately.

Pre-Populated Fields (if applicable):

Some sample tax forms may offer pre-populated fields for common inputs, such as tax year and also filing status, to streamline the process.

Automated Calculations:

Built-in formulas for calculating tax liabilities, refunds, and also other key figures, reducing the chance for errors.

Instructions and Guidelines:

Offers detailed instructions for each section, helping users understand tax requirements and also how to complete each part of the form.

Benefits:

Ease of Use:

Simplifies the tax filing process for individuals or businesses by offering a well-organized, easy-to-follow template.

Reduced Risk of Errors:

Automated calculations and also clear instructions help prevent mistakes, leading to more accurate submissions.

Saves Time:

Prepares tax returns more quickly by offering a structured format and also the ability to fill out essential details efficiently.

Improved Compliance:

Ensures that all required information is included and also that the form is in line with current tax regulations, promoting compliance with the law.

Cost-Effective:

Reduces the need for expensive tax preparation services, allowing individuals or small businesses to file their taxes independently.