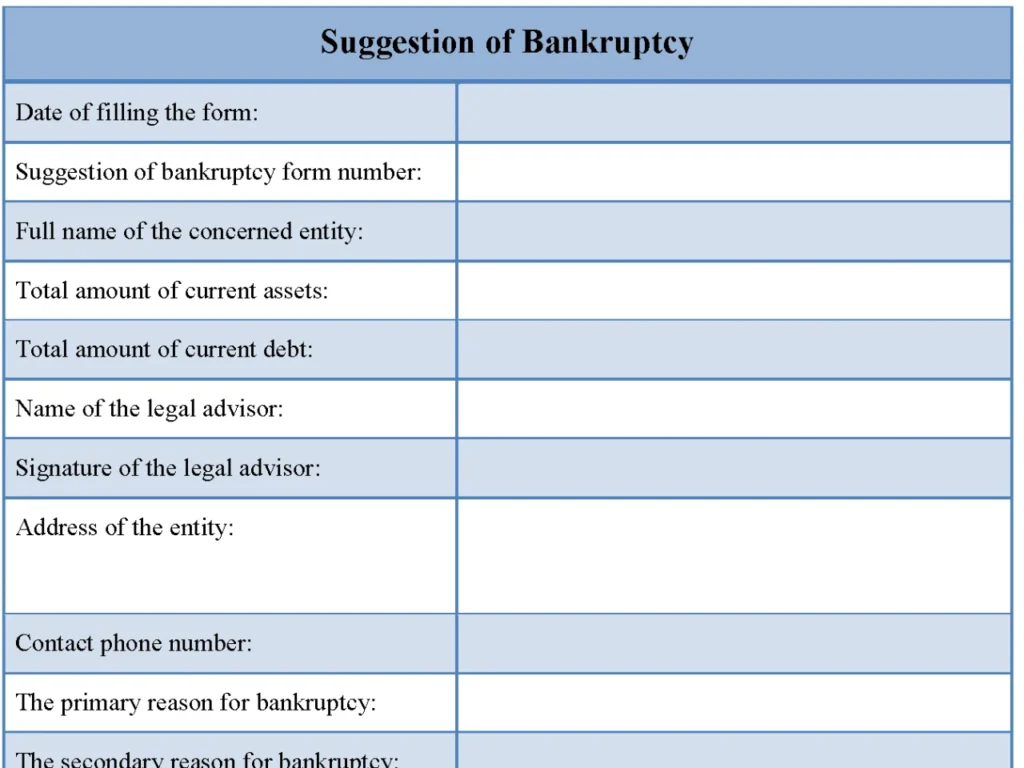

A suggestion of bankruptcy form is a very important document as it clearly lays out pertinent information for a concerned entity in regards to the matters of bankruptcy. The entity files certain details in this case and relevant regulatory authorities and sources are mentioned in the form. The document has a strong legal weight attached to it

You can Download the Suggestion of Bankruptcy Template post; customize it according to your needs and Print. Suggestion of Bankruptcy Form is either in MS Word and Editable PDF.

Download Editable Suggestion of Bankruptcy Template for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Suggestion Of Bankruptcy Template

the Suggestion of Bankruptcy Template, a vital document in the bankruptcy process. This form serves as a formal request or recommendation for an individual or entity to declare bankruptcy. Whether you’re a debtor seeking relief from overwhelming debt or a creditor suggesting bankruptcy for a debtor who is unable to meet financial obligations, this form initiates the legal proceedings necessary for financial restructuring.

Bankruptcy is a complex legal process that offers debtors a fresh start by resolving their debts under the protection and supervision of the court. The Suggestion of Bankruptcy Form plays a pivotal role in this process by officially notifying the court of the debtor’s financial distress and initiating the necessary legal procedures.

As you complete this form, ensure accurate and comprehensive disclosure of relevant financial information. Whether you are the debtor or the party suggesting bankruptcy, honesty and transparency are essential to facilitate a fair and efficient resolution.

Please consult legal counsel or financial advisors if you have any questions or require assistance during the completion of this form. The Suggestion of Bankruptcy Form marks the beginning of a journey towards financial stability and a fresh start, and it’s essential to navigate it with care and diligence.