A working tax credit form is an official document that contains the details of a taxpayer who wishes to gain tax credits from the tax department citing the information of his employment status and few statistics. The work tax credit form has a legal weight that can be used as an instrument in certain administrative spheres.

You can Download the Working Tax Credit Form, customize it according to your needs and Print. Working Tax Credit Form is either in MS Word and Editable PDF.

Download the Working Tax Credit Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Eligibility Sections:

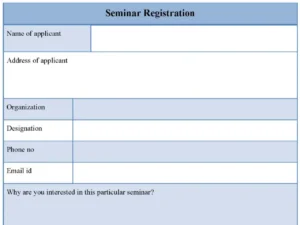

Clearly defined sections to capture personal details, income, and employment status, ensuring the correct information is collected for eligibility assessment.

Income Breakdown Fields:

Dedicated fields for documenting all sources of income, including employment, self-employment, and other allowances, to support accurate claim processing.

Taxable Benefits Input:

Space to enter other taxable benefits to ensure accurate calculations and avoid overpayments.

Benefits:

Simplifies Claim Process:

Provides a structured format that makes it easier to fill out and submit necessary information, reducing time spent on applications.

Increases Accuracy:

Reduces errors by guiding applicants through required fields, ensuring complete and accurate information is provided.

Speeds Up Processing:

With all necessary information in place, the form helps reduce processing times, meaning eligible applicants can receive support faster.

Helps Maximize Entitlements:

By including fields for all relevant financial and personal details, the form helps ensure applicants receive the correct amount based on their circumstances.

Supports Financial Planning:

Knowing that tax credits are accurately calculated helps recipients better plan their monthly finances and manage cash flow.